- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- Sole Proprietorship Form

Sole Proprietorship Form

The sole trader organization (also called proprietorship) is the oldest form of organization and the most common form of organization for small businesses even today. In a proprietorship the enterprise is owned and controlled only by one person. This form is one of the most popular forms because of the advantages it offers. It is the simplest and easiest to form.

Definition of Sole Proprietorship

The sole trader organization (also called proprietorship) is the oldest form of organization and the most common form of organization for small businesses even today. In a proprietorship the enterprise is owned and controlled only by one person. This form is one of the most popular forms because of the advantages it offers. It is the simplest and easiest to form.

The sole trader enjoys full control over the affairs of the firm and responsible for both the profits earned by the business and the loss. Sole Proprietorship is one man's business in which an individual produces independently with his own capital, skill and intelligence and is entitled to receive all the profits and assumes all the risks of ownership. Under this form of business organization, no distinction is made between the business concern and the proprietor.

Main Features

- One man ownership

- No separation of ownership and management

- High degree of supervision and control in the working of his business

- No separate entity from the owner

- All profits belong to proprietor

- Individual risk as all losses in the business are borne by the proprietor himself

- The proprietor has an unlimited liability - personal property of the owner can be attached for business debts

- Ease of formation - less legal formalities

- Not suitable for large scale operations as the resources of the sole trader are limited

Related Links

You May Also Like

-

GL - Different Type of Journals

Two basic types of journals exist: general and special. In this article, the learner will understand the meaning of journalizing and the steps required to create a journal entry. This article will also discuss the types of journals and will help you understand general journals & special journals. In the end, we will explain the impact of automated ERPs on the Journalizing Process.

-

An account inquiry is a review of any type of financial account, whether it be a depository account or a credit account. In this tutorial, you learn what we mean by drill through functionality in the context of the general ledger system. We will explain the concept of drill-down and how it enables users to perform account and transaction inquiry at a granular level and the benefits of using this functionality.

-

In this article, we explain some commonly used subsidiary ledgers like accounts receivable subsidiary ledger, accounts payable subsidiary ledger or creditors' subsidiary ledger, inventory subsidiary ledger, fixed assets subsidiary ledger, projects subsidiary ledger, work in progress subsidiary ledger, and cash receipts or payments subsidiary ledger.

-

Trial Balance in General Ledger

One of the greatest benefits of using a double-entry accounting system is the capability to generate a trial balance. What do we mean by trial balance? As the name suggests a trial balance is a report that must have its debits equals to credits. Understand the importance of trial balance and why it is balanced. Learn how it is prepared and in which format.

-

Although technically a general ledger appears to be fairly simple compared to other processes, in large organizations, the general ledger has to provide many functionalities and it becomes considerably large and complex. Modern business organizations are complex, run multiple products and service lines, leveraging a large number of registered legal entities, and have varied reporting needs.

-

McKinsey 7S Framework is most often used as an organizational analysis tool to assess and monitor changes in the internal situation of an organization. The model is based on the theory that, for an organization to perform well, seven elements need to be aligned and mutually reinforcing.

-

In this article we will focus on and understand the accounting process which enables the accounting system to provide the necessary information to business stakeholders. We will deep dive into each of the steps of accounting and will understand how to identify accounting transactions and the process for recording accounting information and transactions.

-

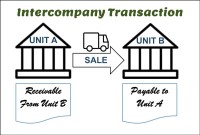

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

-

Different Types of Organizational Structures

Modern business organizations run multiple product and service lines, operate globally, leverage large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders.

-

GL - Different Accounting Methods

The accounting method refers to the rules a company follows in reporting revenues and expenses. Understand the two common systems of bookkeeping, single, and double-entry accounting systems. Learners will also understand the two most common accounting methods; cash and accrual methods of accounting and the advantages and disadvantages of using them.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved