- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

General Ledger

General Ledger – Record to Report Process

The ‘Record to Report’ process, also referred to as ‘Account to Report’ or simply as general ledger process, refers to the maintenance of the general ledger right from recording of transactions to preparation of unit trial balances and reporting company’s consolidated financial results.

Bookkeeping is a critical accounting activity that provides the solid financial foundation on which an organization stands. The correctness and integrity of the financial statements that an organization produces largely depend on the correctness and integrity of its bookkeeping activities. Entry of Journals and review and posting to ledgers are the two core bookkeeping activities. The journals are where all transactions are first recorded on a daily basis. Information from a journal is then posted to the ledgers to update each account. Various accounts in the ledgers are then summarized, tested, and validated, and used for producing financial statements at the end of an accounting period.

Here we will help you understand the basic accounting concepts and expose you to the general ledger process of entry of journals, review, posting summarization, reconciliation and finally reporting and closing of an accounting period. This section from TechnoFunc will help you understand the fundamentals of an effective automated general ledger system and subsequently explain all the important GL concepts including how to analyze a transaction, record it in the appropriate journal, and then post it to the ledgers. We assure you this is the best place to learn the record to report process!!

Record to Report Process

Record to report (R2R) is a finance and accounting management process that involves collecting, processing, analyzing, validating, organizing, and finally reporting accurate financial data. R2R process provides strategic, financial, and operational feedback on the performance of the organization to inform management and external stakeholders. R2R process also covers the steps involved in preparing and reporting on the overall accounts.

What is a General Ledger?

The purpose of the general ledger is to sort transaction information into meaningful categories and charts of accounts. The general ledger sorts information from the general journal and converts them into account balances and this process converts data into information, necessary to prepare financial statements. This article explains what a general ledger is and some of its major functionalities.

General Ledger Overview

What Is a General Ledger? General Ledger (also known in accounting as the GL or the Nominal Ledger) is at the heart of any accounting system. A general ledger is the master set of accounts that summarize all transactions occurring within an entity. Ledger is the skillful grouping and presentation of the Journal entries. Learn the accounting fundamentals, general ledger process, and general ledger flow.

What is Accounting & Book Keeping

Accounting is a process designed to capture the economic impact of everyday transactions. Each day, many events and activities occur in an entity, these events and activities are in the normal course of business; however, each of these events may or may not have an economic impact. Events or activities that have an effect on the accounting equation are accounting events.

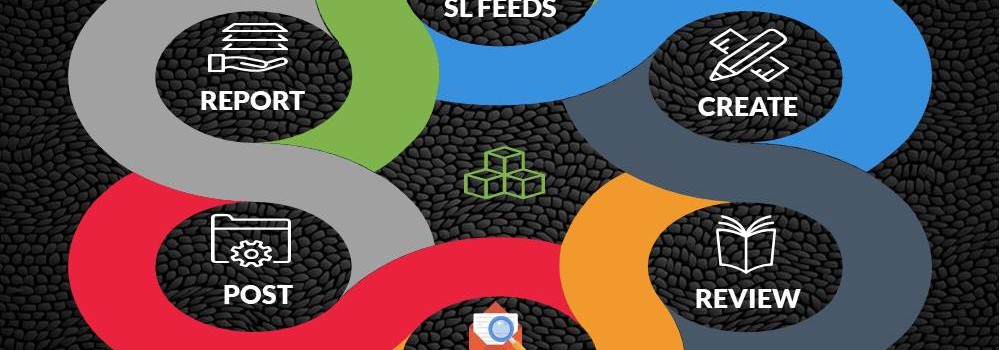

General Ledger Process Flow

In this article, we will explain the general Ledger journal processing flow from entering journals to running the final financial reports. Understand the generic general ledger process flow as it happens in automated ERP systems. The accounting cycle explains the flow of converting raw accounting data to financial information whereas general ledger process flow explains how journals flow in the system.

Complexities in GL System

Although technically a general ledger appears to be fairly simple compared to other processes, in large organizations, the general ledger has to provide many functionalities and it becomes considerably large and complex. Modern business organizations are complex, run multiple products and service lines, leveraging a large number of registered legal entities, and have varied reporting needs.

Benefits of Automated GLs

The general ledger is the central repository of all accounting information in an automated accounting world. Summarized data from various sub-ledgers are posted to GL that eventually helps in the creation of financial reports. Read more to understand the role and benefits of an effective general ledger system in automated accounting systems and ERPs.

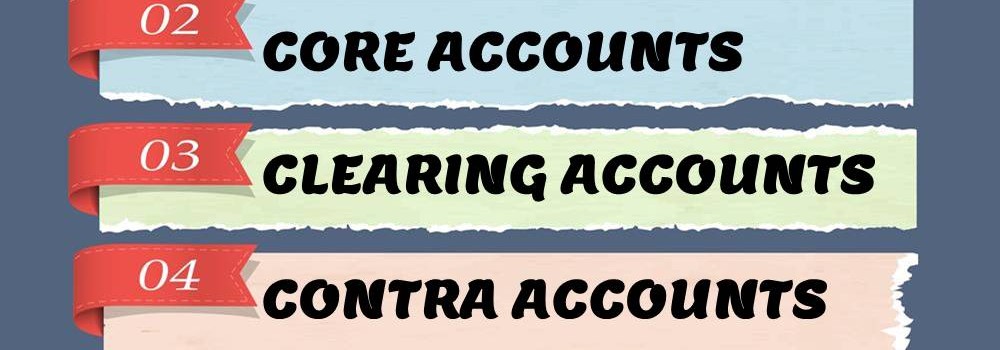

Contra & Control Accounts

There are five types of core accounts to capture any accounting transaction. Apart from these fundamental accounts, some other special-purpose accounts are used to ensure the integrity of financial transactions. Some examples of such accounts are clearing accounts, suspense accounts, contra accounts, and intercompany accounts. Understand the importance and usage of these accounts.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved