- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

General Ledger

General Ledger – Record to Report Process

The ‘Record to Report’ process, also referred to as ‘Account to Report’ or simply as general ledger process, refers to the maintenance of the general ledger right from recording of transactions to preparation of unit trial balances and reporting company’s consolidated financial results.

Bookkeeping is a critical accounting activity that provides the solid financial foundation on which an organization stands. The correctness and integrity of the financial statements that an organization produces largely depend on the correctness and integrity of its bookkeeping activities. Entry of Journals and review and posting to ledgers are the two core bookkeeping activities. The journals are where all transactions are first recorded on a daily basis. Information from a journal is then posted to the ledgers to update each account. Various accounts in the ledgers are then summarized, tested, and validated, and used for producing financial statements at the end of an accounting period.

Here we will help you understand the basic accounting concepts and expose you to the general ledger process of entry of journals, review, posting summarization, reconciliation and finally reporting and closing of an accounting period. This section from TechnoFunc will help you understand the fundamentals of an effective automated general ledger system and subsequently explain all the important GL concepts including how to analyze a transaction, record it in the appropriate journal, and then post it to the ledgers. We assure you this is the best place to learn the record to report process!!

The Subsidiary Ledgers

For any company that has a large number of transactions, putting all the details in the general ledger is not feasible. Hence it needs to be supported by one or more subsidiary ledgers that provide details for accounts in the general ledger. Understand the concept of the subsidiary ledgers and control accounts.

Example of Subsidiary Ledgers

In this article, we explain some commonly used subsidiary ledgers like accounts receivable subsidiary ledger, accounts payable subsidiary ledger or creditors' subsidiary ledger, inventory subsidiary ledger, fixed assets subsidiary ledger, projects subsidiary ledger, work in progress subsidiary ledger, and cash receipts or payments subsidiary ledger.

GL - Enter & Analyze Journals

In every journal entry that is recorded, the debits and credits must be equal to ensure that the accounting equation is matched. In this article, we will focus on how to analyze and recorded transactional accounting information by applying the rule of credit and debit. We will also focus on some efficient methods of recording and analyzing transactions.

GL - Review & Approve Journals

Review and Approval mechanisms ensure that the accounting transaction is reasonable, necessary, and comply with applicable policies. Understand why we need review and approval processes, what are they, and how they are performed in automated general ledger systems. Learn the benefits of having journal approval mechanisms in place.

GL - Periods and Calendars

In some of the ERP tools, there are more than 12 accounting periods in a financial year. This article discusses the concept of accounting calendar and accounting periods. Learn why different companies have different accounting periods. Understand some of the commonly used periods across different organizations and the definition & use of an adjustment period.

GL - Different Accounting Methods

The accounting method refers to the rules a company follows in reporting revenues and expenses. Understand the two common systems of bookkeeping, single, and double-entry accounting systems. Learners will also understand the two most common accounting methods; cash and accrual methods of accounting and the advantages and disadvantages of using them.

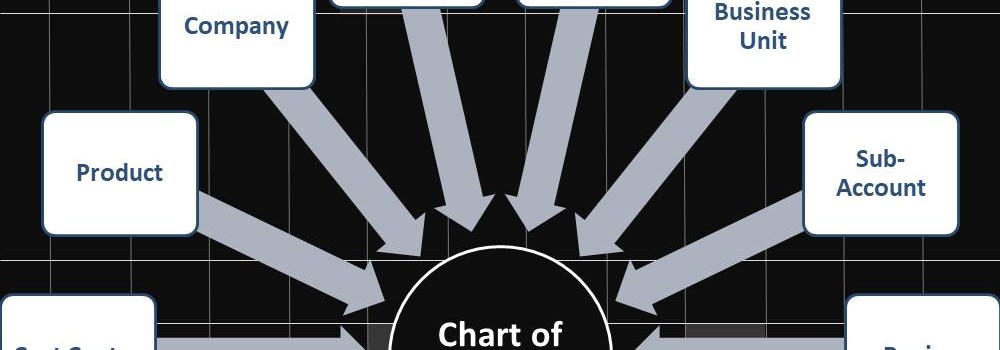

GL - Understanding Chart of Accounts

A chart of accounts (COA) is a list of the accounts used by a business entity to record and categorize financial transactions. COA has transitioned from the legacy accounts, capturing just the natural account, to modern-day multidimensional COA structures capturing all accounting dimensions pertaining to underlying data enabling a granular level of reporting. Learn more about the role of COA in modern accounting systems.

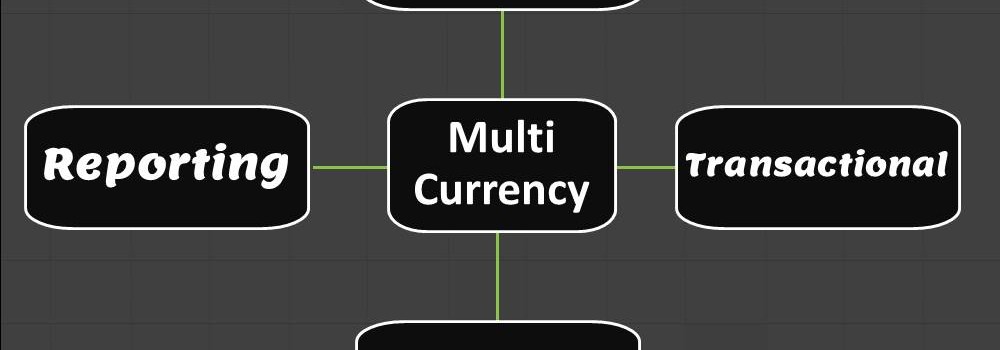

Multi Currency - Functional & Foriegn

Currency is the generally accepted form of money that is issued by a government and circulated within an economy. Accountants use different terms in the context of currency such as functional currency, accounting currency, foreign currency, and transactional currency. Are they the same or different and why we have so many terms? Read this article to learn currency concepts.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved