- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- Asset Management

- Costs subsequent to acquisition of fixed assets

Costs subsequent to acquisition of fixed assets

Costs related to plant assets that are incurred after the asset is placed in use are either added to the fixed asset account (capitalized) or charged against operations (expensed) when incurred. In this article, we will discuss underlying principles for this accounting event.

Most operating assets require expenditures to repair, maintain, or improve them. These subsequent costs can pose accounting problems if they are material in amount or significantly affect the asset’s service life. The FA accountant faces the choice between capitalizing and expensing it in the year in which it occurs.

Components of Cost

The cost of an item of the fixed asset comprises its purchase price, including import duties and other non-refundable taxes or levies and any directly attributable cost of bringing the asset to its working condition for its intended use; any trade discounts and rebates are deducted in arriving at the purchase price.

Examples of directly attributable costs are:

- site preparation;

- initial delivery and handling costs;

- installation cost, such as special foundations for the plant; and

- professional fees, for example, fees of architects and engineers.

The cost of a fixed asset may undergo changes subsequent to its acquisition or construction on account of exchange fluctuations, price adjustments, changes in duties, or similar factors.

Administration and other general overhead expenses are usually excluded from the cost of fixed assets because they do not relate to a specific fixed asset. However, in some circumstances, such expenses as are specifically attributable to the construction of a project or to the acquisition of a fixed asset or bringing it to its working condition may be included as part of the cost of the construction project or as a part of the cost of the fixed asset. The expenditure incurred on start-up and commissioning of the project, including the expenditure incurred on test runs and experimental production, is usually capitalized as an indirect element of the construction cost. However, the expenditure incurred after the plant has begun commercial production, i.e., production intended for sale or captive consumption, is not capitalized and is treated as revenue expenditure even though the contract may stipulate that the plant will not be finally taken over until after the satisfactory completion.

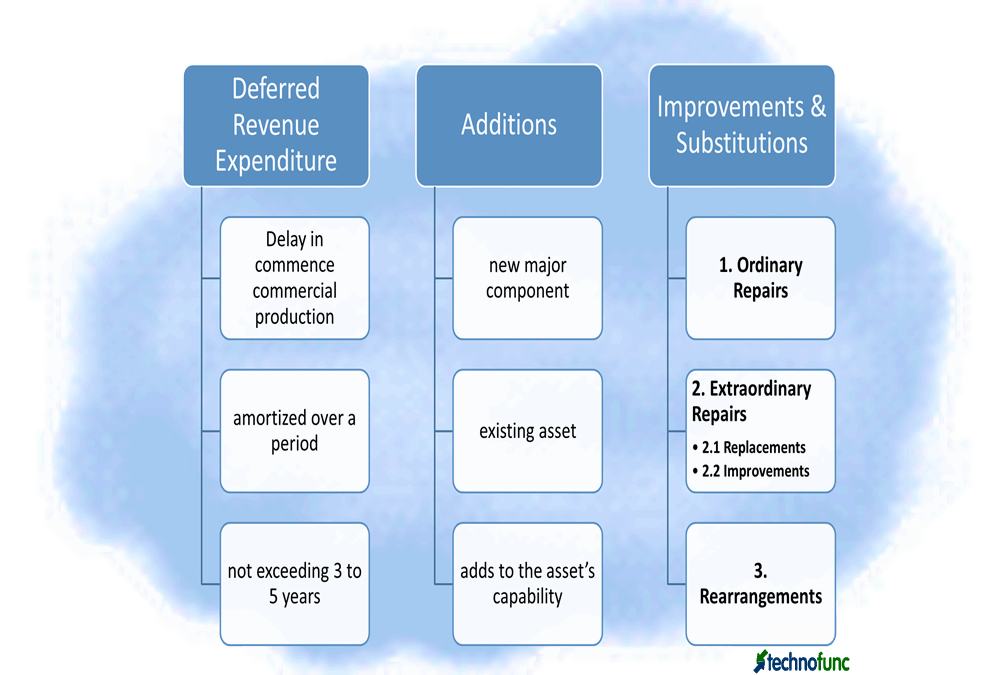

Deferred Revenue Expenditure

If the interval between the date a project is ready to commence commercial production and the date at which commercial production actually begins is prolonged, all expenses incurred during this period are charged to the profit and loss statement. However, the expenditure incurred during this period is also sometimes treated as deferred revenue expenditure to be amortized over a period not exceeding 3 to 5 years after the commencement.

Rearrangement and reinstallation costs are generally carried forward as a separate asset and amortized against future income.

Additions to Fixed Assets

Additions are the expenditures made to add a new major component to an existing asset; typically adds to the asset’s capability but does not extend its useful life. Additions result in the creation of new assets, they should be capitalized. The cost of an addition or extension to an existing asset which is of a capital nature and which becomes an integral part of the existing asset is usually added to its gross book value. Any addition or extension, which has a separate identity and is capable of being used after the existing asset is disposed of, is accounted for separately

Improvements & Substitutions

Improvements and replacements are substitutions of one asset for another. Improvements substitute a better asset for the one currently used, whereas a replacement substitutes a similar asset. The major problem in accounting for improvements and replacements concerns differentiating these expenditures from normal repairs.

Improvements & substitutions may fall in one of the below:

1. Ordinary Repairs

Expenditures made to keep the asset’s usefulness at an appropriate level; adds to neither the useful life nor the capability of the asset.

2. Extraordinary Repairs

Expenditures made to improve the asset’s usefulness Includes:

2.1 Replacements

Expenditures made to substitute a new major component for an existing one; typically extends the asset’s useful life but not its capability.

2.2 Improvements

Expenditures made to substitute a new improved major component for an existing one; typically extends the asset’s useful life and increases its capability.

3. Rearrangements

Expenditures made to restructure the asset without addition, replacement, or improvement; the goal is to create new capability but not necessarily extend useful life.

A truck may have an engine that is in need of replacement. The replacement of the engine represents a “restoration” of some of the original condition (akin to “un-depreciating”). Restoration and improvement type costs are considered to meet the conditions for capitalization because of the enhancement of service life/quality.

Accounting Treatment

For the costs to be capitalized, one of three conditions must be present:

(a) The useful life of the asset must be increased/extended. For example, the expected service life of the asset is long after the investment.

(b) The quantity of service produced from the asset must be increased. The capacity or productivity of the equipment increases. The units of output are higher.

(c) The quality of the units produced must be enhanced. The quality of output is enhanced in some manner. The units produced contain functionality that was not present prior to the investment.

In general, costs incurred to achieve greater future benefits from the asset should be capitalized. It should be capitalized only if an improvement or replacement increases the future service potential of the asset.

Capitalization may be accomplished by:

(a) Substituting the cost of the new asset for the cost of the asset replaced,

(b) Capitalizing the new cost without eliminating the cost of the asset replaced, or

(c) Debiting the expenditure to accumulated depreciation.

Frequently, it is difficult to determine whether subsequent expenditure related to fixed asset represents improvements that ought to be added to the gross book value or repairs that ought to be charged to the profit and loss statement. Only expenditure that increases the future benefits from the existing asset beyond its previously assessed standard of performance is included in the gross book value, e.g., an increase in capacity. The specific facts related to the situation will aid in determining the most appropriate method to use.

Expenditures that simply maintain a given level of service such as normal repairs should be expensed. Subsequent expenditures related to an item of a fixed asset should be added to its book value only if they increase the future benefits from the existing asset beyond its previously assessed standard of performance.

Most items of PP&E require substantial ongoing costs to keep them in good order. The accounting rules for such costs treat them as “capital expenditures” if future economic benefits result from the expenditure. Future economic benefits occur if the service life of an asset is prolonged, the quantity of services expected from an asset is increased, or the quality of services expected from an asset is improved.

In many instances, a considerable amount of judgment is required in deciding whether to capitalize or expense an item. However, the consistent application of a capital/expense policy is normally more important than attempting to provide theoretical guidelines.

Related Links

You May Also Like

-

Fixed Assets - Key Terminology

In this article, we have explained the meaning and usage of key generic terms that are used in almost every FA management system/ Fixed Assets process. Understanding these terms is a prerequisite to building a solid understanding of the fixed assets business process.

-

Asset Maintenance – Tagging & Physical Verification

Most organizations need to deal with hundreds or even thousands of physical assets. In such a case, it’s important to know the operating condition and location of the assets owned by them at periodical intervals. Identifying, tracking, and controlling assets are a critical step in ‘Asset Maintenance’.

-

Introduction to Capital Asset Planning

Before you purchase an asset in any organization, you must justify the decision to purchase the asset and get requisite approvals to make investment and release the funds. These series of analysis steps where cost-benefit analysis is performed to justify the decision to purchase a prospective asset is called the process of capital asset planning or simply as capital budgeting.

-

Physical assets are frequently out in the field for use; undergo repairs, sold, updated, removed or stolen. From purchase to disposal and all of the steps in between, an asset’s history can be easily traced and reviewed using an asset management system that utilizes asset tags or asset labels.

-

An asset is anything that will probably bring future economic benefit. Every company must take actions to safeguard, control, and manage the assets it owns. Cash Assets needs to be managed effectively to safeguard and utilize them efficiently. In this section, we will start with understanding what are assets, what are various classification of assets and then we will focus on Asset Management.

-

Key challenges in managing FA process

As organizations grow in scale they need a more detailed justification of capital expenditure. This leads to many functions getting involved in the fixed asset management process with significant “hand-offs” at each step/stage. In this chapter, we will address a broad array of issues involved in the process of fixed assets in any large scale organization.

-

“Fixed Assets” is a six-step process and starts with initiating and approving the request to acquire the asset and after maintaining and depreciating for useful life ends with the final disposal of the fixed asset. These steps are cyclic in nature and most of them happen in any fixed management lifecycle. Some optional steps may happen only in certain business scenarios or in specific industries.

-

Costs subsequent to acquisition of fixed assets

Costs related to plant assets that are incurred after the asset is placed in use are either added to the fixed asset account (capitalized) or charged against operations (expensed) when incurred. In this article, we will discuss underlying principles for this accounting event.

-

A fixed asset register (FAR) is accounting book with a list of fixed assets belonging to particular entity. Traditionally the fixed asset register was maintained in written form by the accountant using a book that was set aside specifically for tracking fixed assets. Now with the advent of IT systems for bookkeeping it is more often held in electronic format. Learn the importance of maintaining a FAR.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved