- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger

- Contra & Control Accounts

Contra & Control Accounts

There are five types of core accounts to capture any accounting transaction. Apart from these fundamental accounts, some other special-purpose accounts are used to ensure the integrity of financial transactions. Some examples of such accounts are clearing accounts, suspense accounts, contra accounts, and intercompany accounts. Understand the importance and usage of these accounts.

General Ledger System Accounts:

Automated Accounting Systems are organized set of manual and computerized accounting methods, procedures, and controls to gather, record, classify, analyze, summarize, interpret, and present accurate and timely financial data from computerized systems. For any accounting system to work it needs to understand the distinction between balance sheet and profit and loss items. Automated systems also provide posting of certain special transactions to specified accounts. For these functions to work, seeded account types and accounts are defined in the automated systems. These mandatory pre-defined accounts and account types are referred to as “General Ledger System Accounts”.

Whenever IT professional starts working on any financial project, they encounter certain accounts and account types that are always seeded in the system, they are able to perform setups for those accounts after going through the manual of the software package, but usually explanation about the need and role of these accounts is not available in the product manual/guide. In this tutorial, we will understand what are the minimum account types that need to be seeded in any financial system and "why" certain accounts have to be mandatory in nature before the automated accounting process can start.

In the latter half, we will discuss some special purpose accounts like Suspense Account, Clearing Account, etc. and will focus our discussion on understanding what these accounts are and what roles these accounts play in an automated ERP system. The intended audience for this tutorial is anybody who has a need to work on any financial IT system. This will be helpful to everyone who wants to understand how to design and implement effective automated accounting systems like ERPs. This tutorial focuses on these concepts from the perspective of an IT professional that is expected to work on any project involving design, build or interface to an automated GL system, rather than a student of accounting.

For Information Technology professionals this overview lesson relates important GL accounts to automated accounting systems and will help them understand the role these commonly used accounts play. This chapter will provide a foundation knowledge that will be helpful to IT implementers to explain the future design and ERP functionalities to the end users more effectively. In the setup stages, this will ensure that implementers understand the key differences between different types of accounts and they are able to classify the client's financial data correctly.

During the requirements stage understanding of the system, accounts will help professionals ask relevant questions to understand the company's business processes creating needs for these system accounts. We recommend sharing the video and concepts of this tutorial with the super-users before the requirements gathering session to enable an effective discussion on requirements around system accounts. The concepts presented in this chapter are conceptual in nature and they are applicable to all accounting systems irrespective of the underlying technology. Understanding these concepts is a prerequisite to define and work on an automated General Ledger. This topic is beneficial to both IT professionals as well as end-users. Persons seeking specialized accounting knowledge will also benefit from these discussions.

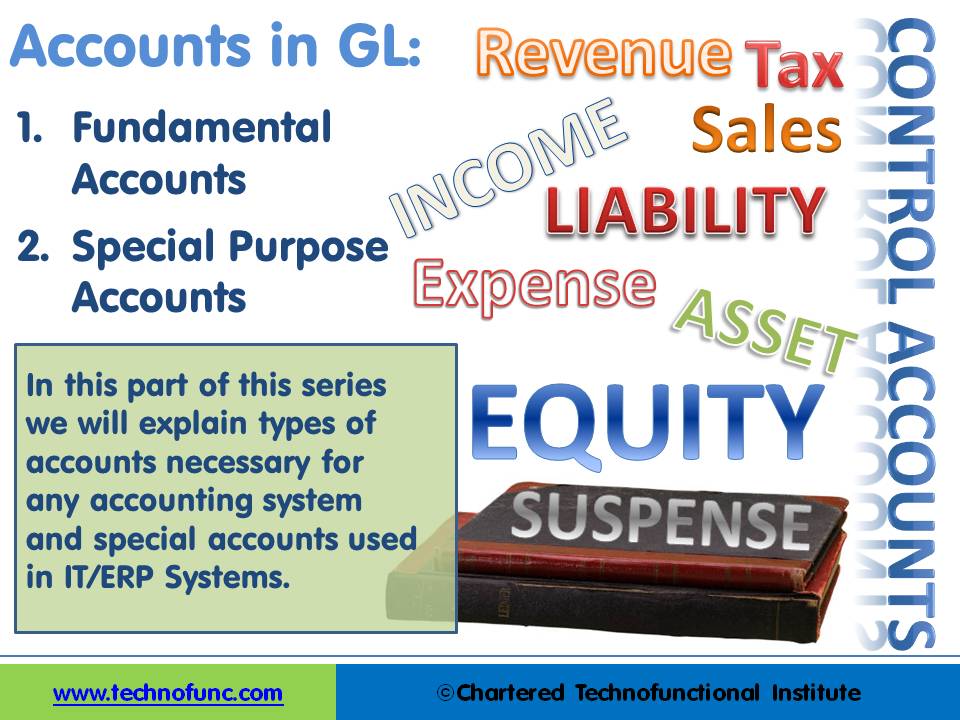

Mandatory accounts in GL can be classified into two broad categories – Fundamental Accounts and Special Purpose Accounts. In this part of this series, we will focus on defining these account types and will explore the conceptual knowledge behind these accounts. During this tutorial, we will be doing a deep dive into both account types, discussing individual accounts in detail.

TechnoFunc Definitions:

1. Fundamental Accounts:

Business operations may result in financial benefits or losses that arise as a difference in revenue gained from business activity and expenses, costs, and taxes needed to sustain the business activity. Any resultant profit or loss goes to the business owner. Funds can be invested by owners or outsiders known as equity & liabilities and can be used to acquire assets to perform business activities. All general ledger accounts can be classified as belonging to either one of these categories – Equity, Liabilities, Assets, Revenue, and Expenses. These are the fundamental account types from the perspective of automated accounting systems. Based on this classification, closing balances are never carried forward in automated GL systems for Revenue and Expense Accounts.

2. Special Purpose Accounts:

Enterprise resource planning (ERP) systems integrate internal and external financial and non-financial information across an entire organization. Transaction flow happens between many interdependent processes and business units embracing finance/accounting, manufacturing, sales and service, customer relationship management, etc. When one end to end transaction needs to be routed through multiple processes and modules, special-purpose accounts helps in tracking financial flow and facilitates accounting reconciliation among different input and output transactional processes.

A new category of accounts also classified as “Special Purpose Accounts” like Contra accounts, Intercompany accounts, Clearing accounts, and suspense accounts, etc. are defined to track the entire financial flow and identify and reconcile intermediary handoffs. In any business that is going for large automated accounting systems, you can expect and a large number of business transactions and parallel and sequential processes catering to different business requirements.

Let’s try to understand some flows that are happening at all times:

Business Flows:

The business has its own legal and physical structure. It deals in products or services and interacts with lots of third parties like suppliers and customers who interact with accounting systems while performing normal business transactions with the entity. If business transactions result in financial transactions, these business flows interact with the organization’s Accounting Flows.

Internal Process Flows: Company has its own set of rules, procedures, and processes to perform business activities. Creating repeatable business processes is an important part of building and running an effective organization. Well-designed and documented business processes are critical for the success of business activities. These internal process flows also encompasses material flows. For example, before releasing the material to the end customer it needs to be moved from a wholesale warehouse to a retail warehouse. These process flows are for normal business activities and when these activities are financial in nature they interact with Accounting Flows.

Accounting Flows:

For each of the processes, whether they are internal or external, effective systems should automatically assist the generation of accounting entries and track inventory, assets, liabilities, and profitability of the organization. In these internal processes, there is a need to break the accounting transaction into sub-transactions to identify and track these interdependent steps in these flows. For example when the material is received from the supplier, debit the inventory account and credit the AP Clearing Account (Because at that particular step, Payables Department has not received the invoice for the material received). Once the invoice is recorded in the subsequent Payables Process, the clearing account can be netted off with the actual liability account.

This helps us understand how one single transaction needs to be routed through multiple processes and modules. These special-purpose accounts help in tracking financial flow and facilitates accounting reconciliation among different transactional processes as explained in our example for Inventory and Payables. These clearing accounts are classified as “Special Purpose Accounts” and are used to track the entire financial flow and identify and reconcile intermediary handoffs.

Related Links

You May Also Like

-

Functional Organizational Structures

A functional organizational structure is a structure that consists of activities such as coordination, supervision and task allocation. The organizational structure determines how the organization performs or operates. The term organizational structure refers to how the people in an organization are grouped and to whom they report.

-

Business Metrics for Management Reporting

Business metric is a quantifiable measure of an organization's behavior, activities, and performance used to access the status of the targeted business process. Traditionally many metrics were finance based, inwardly focusing on the performance of the organization. Businesses can use various metrics available to monitor, evaluate, and improve their performance across any of the focus areas like sales, sourcing, IT or operations.

-

A Company (also called corporation) may be understood as an association of persons in which money is contributed by them, to carry on some business or undertaking. Persons who contribute the money are called the shareholders or the members of the company. A corporation is an artificial being, invisible, intangible and existing only in contemplation of law. Being the mere creature of law, it possesses only those properties which the charter of its creation confers upon it.

-

Internally, an organization can be structured in many different ways, depending on their objectives. The internal structure of an organization will determine the modes in which it operates and performs. Organizational structure allows the expressed allocation of responsibilities for different functions and processes to different entities such as the branch, department, workgroup and individual.

-

GL - Recurring Journal Entries

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Learn the various methods that can be used to generate recurring journals. See some examples and explore the generic process to create recurring journals in any automated system.

-

In some of the ERP tools, there are more than 12 accounting periods in a financial year. This article discusses the concept of accounting calendar and accounting periods. Learn why different companies have different accounting periods. Understand some of the commonly used periods across different organizations and the definition & use of an adjustment period.

-

A subsidiary is a company that is completely or partly owned by another corporation that owns more than half of the subsidiary's stock, and which normally acts as a holding corporation which at least partly or wholly controls the activities and policies of the daughter corporation.

-

This article explains the process of entering and importing general ledger journals in automated accounting systems. Learn about the basic validations that must happen before the accounting data can be imported from any internal or external sub-system to the general ledger. Finally, understand what we mean by importing in detail or in summary.

-

Understand what we mean by GAAP to STAT adjustments. This article discusses the different standards that are used for multiple representations of the financial results for global organizations. Understand the meaning of US GAAP, Local GAAP, STAT, IFRS, and STAT. Finally, understand why accounting differences arise and how they are adjusted for different financial representations.

-

A legal entity is an artificial person having separate legal standing in the eyes of law. A Legal entity represents a legal company for which you prepare fiscal or tax reports. A legal entity is any company or organization that has legal rights and responsibilities, including tax filings.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved