- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- Treasury Management

- Cash Management - Process

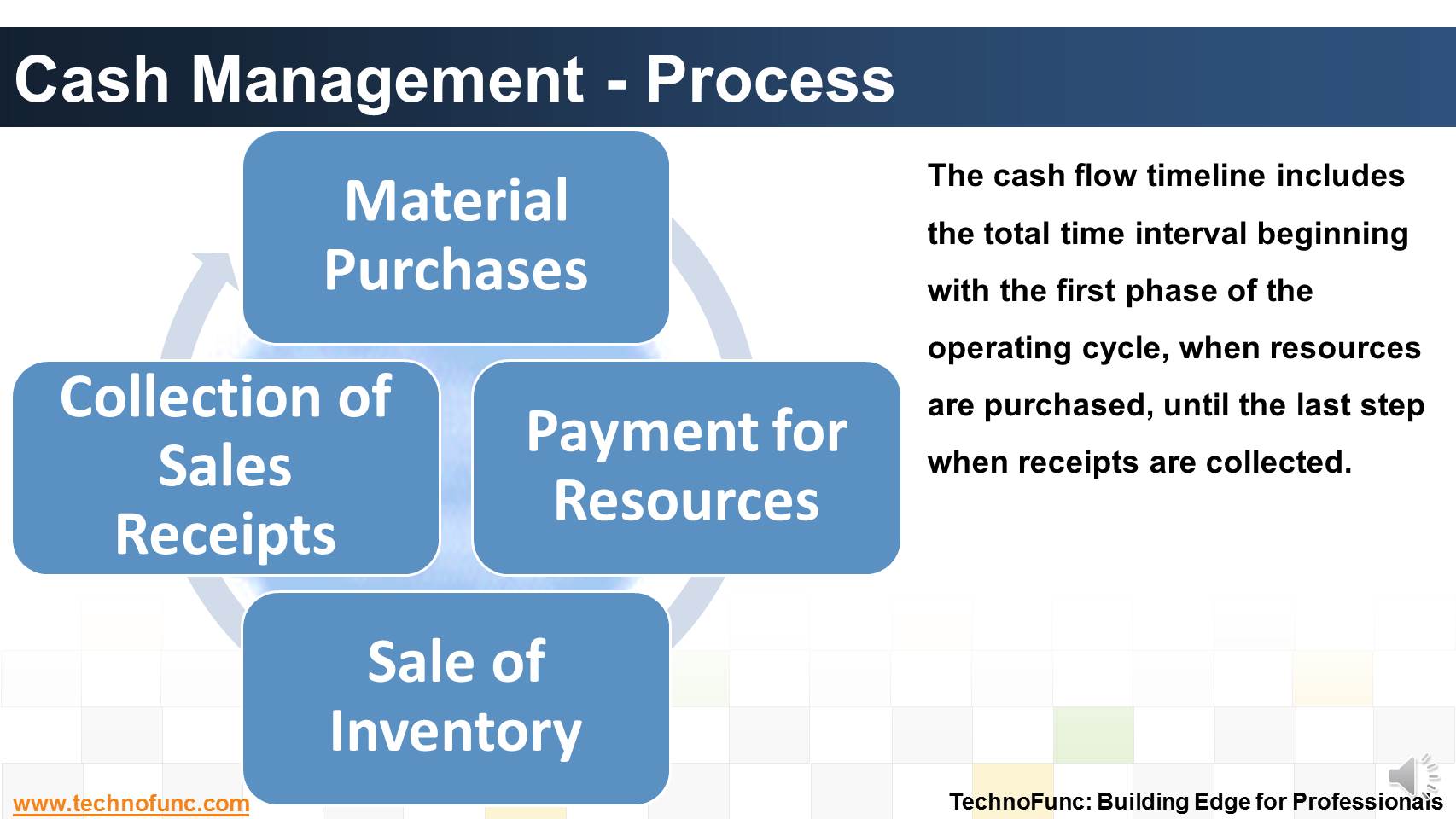

Cash Management - Process

How the inflow and outflow of cash is linked to the operating cycles of the business? Learn the cash management process in an enterprize and it's key components.

The cash flow timeline includes the total time interval beginning with the first phase of the operating cycle, when resources are purchased, until the last step when receipts are collected.

It consists of 4 basic steps.

1. Material purchases.

Acquisition of raw materials or merchandise for resale includes negotiation of the method of payment, credit terms and trade and payment discounts.

2. Payment for resources.

All resources required to support sales, including labor, marketing and overhead expenses, incur financing costs until cash is collected for sales made.

3. Sale of inventory or services.

Merchandise and other sales are most frequently accomplished by extending credit to customers. The timing of accounts receivable collection is a major focus in cash management.

4. Collection of receipts.

Only when the customer has provided good funds for the merchandise or service does the cash flow cycle conclude for that transaction.

Related Links

You May Also Like

-

The objective of Financial risk management is to protect assets and cash flows from any risk. Treasury function works to accurately assess financial risks by identifying financial exposures including foreign exchange, interest rate, credit, commodity and other enterprise risks. Learn about the various risks that are managed by treasury.

-

Treasury has increasingly become a strategic business partner across all areas of the business, adding value to the operating divisions of the company. Managing activities that were traditionally carried out within the general finance function. Learn about the drivers for this change.

-

Many different accounts are used in finance. Understand the representation and nature of clearing account in context of accounting, finance and ERP Systems.

-

How the inflow and outflow of cash is linked to the operating cycles of the business? Learn the cash management process in an enterprize and it's key components.

-

Why enterprises need cash management. What is the purpose of having a well defined cash management process?

-

Technology has enabled the treasury function by providing various solutions to manage it's complicated tasks. This article explains various types of treasury management systems available in the market.

-

In automated clearing, Bank statement details are automatically matched and reconciled with system transactions. Learn how this process works and what are the perquisites to enable the same.

-

Disbursement Float is the time taken from payment creation to settlement. Collection float is the sum total of time taken by Payment Float; Mail Float; Processing Float and Availability Float. Learn more!

-

Bank Reconciliation is a PROCESS to Validate the bank balance in the general ledger With Bank Statement. Learn the bank recon process.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved