- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

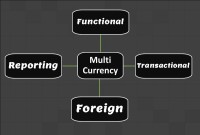

- Functional

- General Ledger (Record to Report)

- What is Accounting & Book Keeping

What is Accounting & Book Keeping

Accounting is a process designed to capture the economic impact of everyday transactions. Each day, many events and activities occur in an entity, these events and activities are in the normal course of business; however, each of these events may or may not have an economic impact. Events or activities that have an effect on the accounting equation are accounting events.

What is accounting?

Accounting is the process of transforming the financial information associated with economic activity into usable financial information. Accounting is the art of recording, summarizing, reporting, and analyzing financial transactions. An accounting system can be a simple, utilitarian check register, or, as with modern automated enterprise resource planning systems, it can be a complete record of all the activities of a business, providing details of every aspect of the business, allowing the analysis of business trends, and providing insight into future prospects.

The American Institute of Certified Public Accountants (AICPA)

Accountancy is "the art of recording, classifying, and summarizing in a significant manner and in terms of money, transactions, and events which are, in part at least, of financial character, and interpreting the results thereof."

The outcome of the accounting process is a group of financial statements that reflect an organization's financial position, liquidity, and profitability. Periodically, financial statements are prepared to reveal the financial position and the results of operations. These financial statements are the output of the accounting process and become an input into the analysis and decision-making activities of business owners, investors, managers, creditors, and government regulators.

These financial statements or reports are shared with the stakeholders (interested parties) who analyze, interpret, and use this accounting information for their own purposes. This information helps the users with their analysis and decision making for various objectives like investment or understanding and improving the current business. Automated accounting is an information system that provides reports to stakeholders about the economic activities and conditions of a business.

The etymology of Word Accountant:

The word "Accountant" is derived from the French word Compter, which took its origin from the Latin word Computer. The word was formerly written in English as "Accomptant", but in process of time the word, which was always pronounced by dropping the "p", became gradually changed both in pronunciation and in orthography to its present form as “Accountant”

What is the role of accounting in business?

As discussed earlier, accounting provides information for managers to use in operating the business effectively and efficiently. In addition, accounting provides information to other stakeholders to use in assessing the economic performance and condition of the business. Accounting is generally referred to as the “language of business.” This is because accounting is the means by which business information is communicated to the stakeholders.

For example, accounting reports summarizing the profitability of a new product help management decide whether to continue selling the product. Likewise, financial analysts use accounting reports in deciding whether to recommend the purchase of the Company’s stock. Banks use accounting reports in determining the amount of credit to extend to the company and suppliers on the other hand use accounting reports in deciding whether to offer credit to the company for purchases of supplies and raw materials. Governments and other statutory bodies use accounting reports to calculate and assess taxes appropriately.

Role of Accounting Department:

The accounting job is typically done by the Accounting Department, led by an accounting manager, controller, comptroller, or similar title. These folks record all the transactions that occur as the company does its business and then prepare reports that help the company management, and outside constituencies understand the financial impact of those transactions.

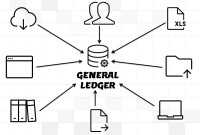

The accountants maintain the accounting software, process all the documentation pertaining to transactions that have occurred and record them into the company's general ledger. From all these transaction records the accountants are able to prepare a variety of reports. Some are for people outside the company, like the government, bankers, investors, and stockholders and others are the reports that are important for running the company efficiently. Accountants prepare financial reports that managers use to understand their company’s financial past and make decisions about its financial future. Automated accounting programs typically produce a variety of reports and we'll discuss these reports in-depth in later sub-sections that pertain to the general ledger.

What is bookkeeping?

Bookkeeping is the practice of recording transactions. Bookkeepers tend to focus on the details, recording transactions in an efficient and organized manner, and they may or may not see the overall picture. Accountants use the work done by bookkeepers to produce and analyze financial reports. Although accounting follows the same principles and rules as bookkeeping, accounting converts them into meaningful financial information that captures all of the details necessary to satisfy the needs of the business — managerial, financial reporting, projection, analysis, and tax reporting. Effective accounting practices across a company will create a system of financial reporting that gives a complete picture of the business.

Related Links

You May Also Like

-

A Company (also called corporation) may be understood as an association of persons in which money is contributed by them, to carry on some business or undertaking. Persons who contribute the money are called the shareholders or the members of the company. A corporation is an artificial being, invisible, intangible and existing only in contemplation of law. Being the mere creature of law, it possesses only those properties which the charter of its creation confers upon it.

-

GL - Journal Posting and Balances

In this tutorial, we will explain what we mean by the posting process and what are the major differences between the posting process in the manual accounting system compared to the automated accounting systems and ERPs. This article also explains how posting also happens in subsidiary ledgers and subsequently that information is again posted to the general ledger.

-

What Is a General Ledger? General Ledger (also known in accounting as the GL or the Nominal Ledger) is at the heart of any accounting system. A general ledger is the master set of accounts that summarize all transactions occurring within an entity. Ledger is the skillful grouping and presentation of the Journal entries. Learn the accounting fundamentals, general ledger process, and general ledger flow.

-

In this article, we explain some commonly used subsidiary ledgers like accounts receivable subsidiary ledger, accounts payable subsidiary ledger or creditors' subsidiary ledger, inventory subsidiary ledger, fixed assets subsidiary ledger, projects subsidiary ledger, work in progress subsidiary ledger, and cash receipts or payments subsidiary ledger.

-

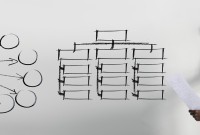

Legal Structures in Businesses

Businesses not only vary in size and industry but also in their ownership. Most businesses evolve from being owned by just one person to a small group of people and eventually being managed by a large numbers of shareholders. Different ownership structures overlap with different legal forms that a business can take. A business’s legal and ownership structure determines many of its legal responsibilities.

-

As the business grows, the company may want to transition to a branch structure as branches are allowed to conduct a much broader range of activity than representative offices. Branches can buy and sell goods, sign contracts, build things, render services, and generally everything that a regular business can do. A company expands its business by opening up its branch offices in various parts of the country as well as in other countries.

-

Learn the typical accounting cycle that takes place in an automated accounting system. We will understand the perquisites for commencing the accounting cycle and the series of steps required to record transactions and convert them into financial reports. This accounting cycle is the standard repetitive process that is undertaken to record and report accounting.

-

This article explains the process of entering and importing general ledger journals in automated accounting systems. Learn about the basic validations that must happen before the accounting data can be imported from any internal or external sub-system to the general ledger. Finally, understand what we mean by importing in detail or in summary.

-

In this article we will discuss various types of "Management Entities". Various types of operational units, are created by management, to effectively run, manage and control their business. Different types of functional units, and divisional units, are widely used across industry.

-

A legal entity is an artificial person having separate legal standing in the eyes of law. A Legal entity represents a legal company for which you prepare fiscal or tax reports. A legal entity is any company or organization that has legal rights and responsibilities, including tax filings.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved