- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- Defining Organizational Hierarchies

Defining Organizational Hierarchies

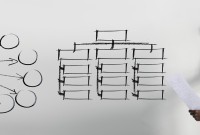

A hierarchy is an ordered series of related objects. You can relate hierarchy with “pyramid” - where each step of the pyramid is subordinate to the one above it. One can use drill up or down to perform multi-dimensional analysis with a hierarchy. Multi-dimensional analysis uses dimension objects organized in a meaningful order and allows users to observe data from various viewpoints.

Meaning of Hierarchies

A hierarchy is an ordered series of related objects. You can relate hierarchy with “pyramid” - where each step of the pyramid is subordinate to the one above it. One can use drill up or down to perform multi-dimensional analysis with a hierarchy. Multi-dimensional analysis uses dimension objects organized in a meaningful order and allows users to observe data from various viewpoints. These hierarchies need to be mapped to systems to ensure they are capturing the relevant business process information at relevant nodes to provide meaningful information for internal and external reporting.

Example

The account hierarchy allows you to map complex organizational structures of a business partner (for example, buying group, co-operative or chain of retail outlets). When you create a hierarchy structure, you form groups of business partners (for example, for purchasing groups). You can use them for statistical purposes and for marketing and accounting and other meaningful analyses.

Organizational hierarchies

Organizational hierarchies represent the relationships between the units/segments that make up your business.

Larger organizations may require some hierarchies that are based on business units and other hierarchies that are based on shared services, such as human resources and IT. They need to create cost centers in shared service departments and position them under business units, so that the costs of shared services are appropriately allocated. Now we will explore some examples of reporting needs arising out of these different hierarchies and dimensions. Any how they add complexity at transactional level to record relevant information appropriately.

Some areas where we need to deal with dimensions/hierarchies are:

Legal Structure

- Legal Entities

- Subsidiaries

- Tax Entities

- Statutory Entities

Operational Structure

- Business Units/Management Entity

- Divisions/Departments

- Business Functions

- Business Support Functions

- Organization Support Functions

- Cost Centers

- Profit Centers

- Business Employee Hierarchy

- Business Area /Project Area/ Controlling Area/ Product Lines/Service Lines

- Countries/Geography/Locations

- Accounts/Sub Accounts

Importance of Hierarchies

Defining organizational hierarchies enable to view and report on your business from different perspectives. You set up a hierarchy of legal entities for tax, legal, regulatory or statutory reporting. Various Legal entities can enter into legal contracts and are required to prepare statements that report on their performance. While performing business activities we need to capture and classify transactions at legal entity level to be able to identify transactions that belong to a specific legal entity. Therefore, there exists a need to define boundary at legal entity level to enable data classification, consolidation, security and reporting at these entity levels.

Example

A large corporate may create a central mailroom to receive all invoices from its vendors for which it need to make payment. These invoices are raised on separate legal entities within the same corporate group, but mailed to a central processing center for accounting and payment. The shared service resource who is working on these invoices must specify in the Accounting System the different legal entities to ensure proper treatment of these transactions. The payments should be issued from the respective bank accounts belonging to the legal entity on which the invoice has been raised.

You can create a hierarchy for purchasing function to control purchasing policies, rules, and business processes.

Related Links

You May Also Like

-

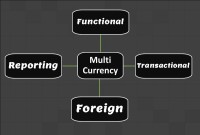

Multi Currency - Functional & Foriegn

Currency is the generally accepted form of money that is issued by a government and circulated within an economy. Accountants use different terms in the context of currency such as functional currency, accounting currency, foreign currency, and transactional currency. Are they the same or different and why we have so many terms? Read this article to learn currency concepts.

-

Functional Organizational Structures

A functional organizational structure is a structure that consists of activities such as coordination, supervision and task allocation. The organizational structure determines how the organization performs or operates. The term organizational structure refers to how the people in an organization are grouped and to whom they report.

-

An account inquiry is a review of any type of financial account, whether it be a depository account or a credit account. In this tutorial, you learn what we mean by drill through functionality in the context of the general ledger system. We will explain the concept of drill-down and how it enables users to perform account and transaction inquiry at a granular level and the benefits of using this functionality.

-

In most of the automated financial systems, you can define more than 12 accounting periods in a financial year. This article will explain the concept of the adjustment period and the benefits of having adjustment periods. Adjustment periods have their inherent challenges for the users of financial statements and there is a workaround for those who don’t want to use adjustment periods.

-

Hierarchical Organization Structures

Hierarchical structure is typical for larger businesses and organizations. It relies on having different levels of authority with a chain of command connecting multiple management levels within the organization. The decision-making process is typically formal and flows from the top down.

-

When the quantum of business is expected to be moderate and the entrepreneur desires that the risk involved in the operation be shared, he or she may prefer a partnership. A partnership comes into existence when two or more persons agree to share the profits of a business, which they run together.

-

In every journal entry that is recorded, the debits and credits must be equal to ensure that the accounting equation is matched. In this article, we will focus on how to analyze and recorded transactional accounting information by applying the rule of credit and debit. We will also focus on some efficient methods of recording and analyzing transactions.

-

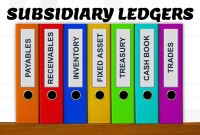

For any company that has a large number of transactions, putting all the details in the general ledger is not feasible. Hence it needs to be supported by one or more subsidiary ledgers that provide details for accounts in the general ledger. Understand the concept of the subsidiary ledgers and control accounts.

-

Concept of Representative Office

A representative office is the easiest option for a company planning to start its operations in a foreign country. The company need not incorporate a separate legal entity nor trigger corporate income tax, as long as the activities are limited in nature.

-

General Ledger - Advanced Features

Modern automated general ledger systems provide detailed and powerful support for financial reporting and budgeting and can report against multiple legal entities from the single system. These systems offer many advanced functionalities right from journal capture to advanced reporting. This article will provide an overview of some advanced features available in today's General Ledgers.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved