- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- Cash Management

- Automated Clearing

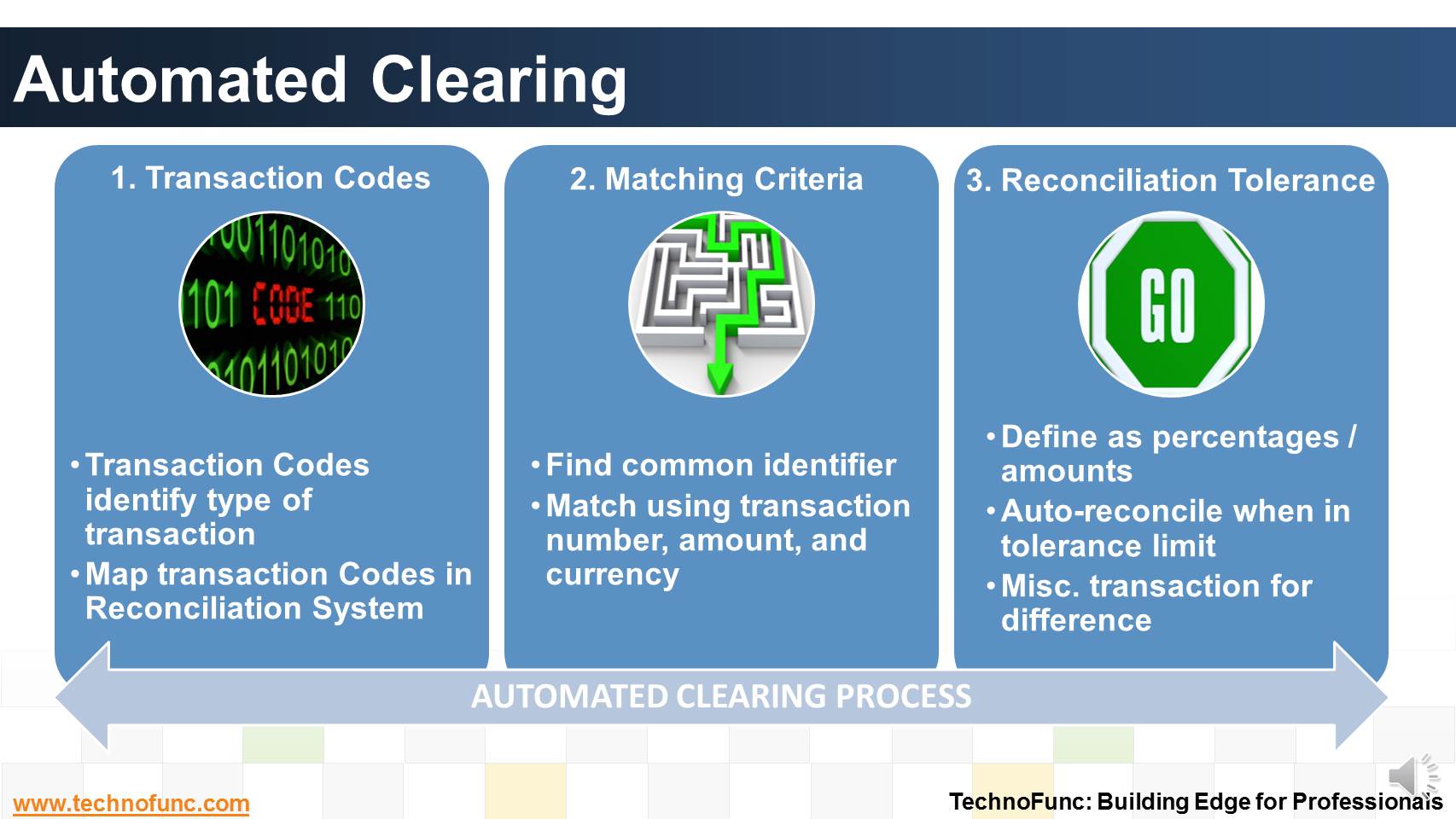

Automated Clearing

In automated clearing, Bank statement details are automatically matched and reconciled with system transactions. Learn how this process works and what are the perquisites to enable the same.

Automated Clearing

In automated clearing, Bank statement details are automatically matched and reconciled with system transactions.

This method is ideally suited for bank accounts that have a high volume of transactions.

The following three are the basic steps are involved in Automated Clearing Process:

1 Map Transaction Codes

Bank statement lines are coded to identify the type of transaction the line represents. Since each bank might use a different set of transaction codes, the first step towards automatic clearing is to map each code that is used by a particular bank for which the transactions need to be reconciled.

2 Matching Criteria

Automated matching can only be done if you can find a common identifier between the transaction details as recorded in your sub ledgers and the bank statement.

Automated systems generally match a bank statement line against a payables payment transaction, receivables receipt transaction, payroll disbursals and miscellaneous transactions using a transaction number (such as the payment or deposit number), bank account, amount, and currency.

3 Reconciliation Tolerance:

Reconciliation tolerances are defined in the system as percentages and/or amounts.

If tolerance is defined then the difference between the statement line and sub-ledger transaction line will be auto-reconciled when it is within the tolerance limit. The system also creates a miscellaneous transaction for the difference between the remittance batch amount and the bank statement line.

Related Links

You May Also Like

-

Have you ever wondered what is actually a Bank Statement and why it is needed. What is the information that is available in a bank statement?

-

Account Reconciliation – How? Learn the three key attributes to perfom account reconciliation.

-

In the previous article we talked about the meaning of the account reconciliations. Now as you now the definition of account reconciliation, in this article let us see why it is carried out.

-

Technology has enabled the treasury function by providing various solutions to manage it's complicated tasks. This article explains various types of treasury management systems available in the market.

-

The terms Treasury Management and Cash Management are sometimes used interchangeably, while, in fact, the scope of treasury management is larger and includes funding and investment activities as well. Learn all about Treasury Management here!

-

Learning objectives for this lesson are: Meaning of Order to Cash Process; Sub Processes under Order to Cash; Process Flow for Order to Cash; Key Roles & Transactions; Key Setups/Master Data Requirements.

-

Many different accounts are used in finance. Understand the representation and nature of clearing account in context of accounting, finance and ERP Systems.

-

In automated clearing, Bank statement details are automatically matched and reconciled with system transactions. Learn how this process works and what are the perquisites to enable the same.

-

What are the various sources of cash in an organization. Which sources increase the cash available with the enterprise and which sources results in outflow of the cash? Let us explore!

-

The topic for this lesson is "Introduction to Cash Management Process". We start with the learning objectives for building requisite functional expertise in cash management process.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved