- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- Procure to Pay

- Accounts Payable Journal Entry

Accounts Payable Journal Entry

Although in the large organizations the Procure to Pay Accounting process starts when the purchase order for supply of goods is released to the supplier. To keep things simple in the beginning we will discuss the core accounting entries related to the Accounts Payables process.

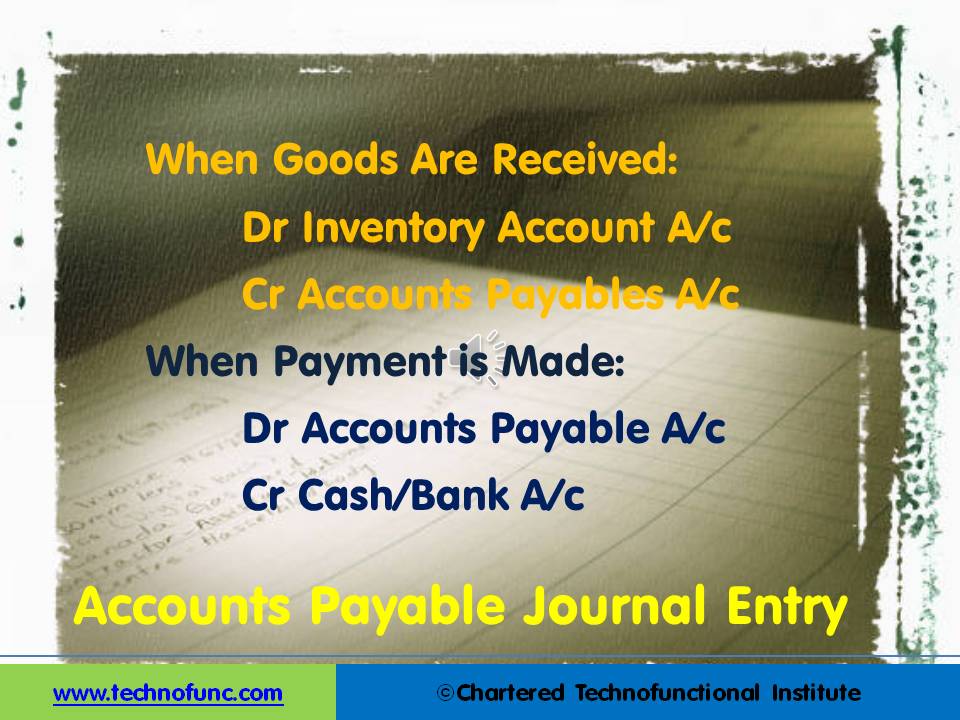

Accounts Payable Journal Entry

As discussed earlier “Accounts Payable” refers to the accounting entry that indicates a short term liability payable to the supplier of goods and services for the goods supplied or services rendered.

Although in the large organizations the Procure to Pay Accounting process starts when the purchase order for supply of goods is released to the supplier. To keep things simple in the beginning we will discuss the core accounting entries related to the Accounts Payables process.

Receipt of Goods:

You issue purchase order to the supplier and he supplies you with the goods. Once the ownership of the goods gets transferred from the supplier to us, we account for the goods as our inventory and based on the invoice received from the supplier need to create a liability for the payment due to him. At this stage the accounting entry is:

Debit Inventory Account

Credit Accounts Payable Account

Making Payment to the Supplier:

Once the payment for the invoice is released then funds gets released from the bank or cash and the amount due to the supplier gets knocked off. For this part the accounting entry is:

Debit Accounts Payable Account

Credit Cash/Bank Account

Related Links

You May Also Like

-

This article discusses the key documents that gets generated during the import/export process. These documents may apply to both invoice to cash as well as order to cash cycles. Also learn the major custom docments for India.

-

To stay competitive in today’s tough market, the location of your warehouse is vital. To grow retail business need to offer to customers faster and affordable shipping time, which is dependent on the warehousing location as the location of the warehouse affects the transit time to ship orders to customers.

-

Overview of Third-Party Logistics

Third-party logistics (abbreviated as 3PL, or TPL) is an organization's use of third-party businesses to outsource elements of its distribution, warehousing, and fulfillment services. A third-party logistics provider (3PL) is an asset-based or non-asset based company that manages one or more logistics processes or operations (typically, transportation or warehousing) for another company.

-

Subsidiary Ledgers – AP Ledger

An accounts payable invoice gets recorded in the Account Payable sub-ledger at the time an invoice is received and validated that the respective goods corresponding to the invoice have been received. Then it is verified and vouchered for payment as per the payment terms agreed with the Supplier.

-

Miscellaneous Warehouse Processes

At the end of each inventory control, the Contractor provides the Ordering Person with an inventory report which contains a list of all stock adjustments. The Ordering Person uses the report to create, by use of his/her own means, necessary value and accounting adjustments related to the stock. Let us look at some to the mislaneous warehouse processes not covered earlier.

-

When a customer wants a product that has been stored in the warehouse, the same need to be picked off the shelf (or off the floor) and get it ready for shipping. Depending on how big is the warehouse, picking can take a while. (Many distribution centers cover more than 1 million square feet.). Hence, warehouse order picking methods are an important aspect within any warehouse.

-

The Outbound process starts with routing the shipments. The Outbound execution process starts from the point when pick tasks are completed for an outbound shipment and ends at the point where the outbound packages are loaded into trailers. The Warehouse Outbound process includes managing and controlling outgoing materials starting from the download of orders through to the shipping of products from the warehouse.

-

We need a strong payables process so that it provides us with a high-productivity accounting solution to process vendor payments. An integrated payables process provides strong financial control so you can prevent duplicate payments, pay for only the goods and services you order and receive, and maximize supplier discounts. Understand the key features of an effective accounts payable system.

-

Warehouses may seem like a simple, straightforward concept, but they actually include a variety of different types of warehouses that all have their own niche. The type of warehousing that’s right for you depends on your specific industry, location, and needs. From private warehousing, distribution centers, and climate-controlled warehouses, there’s an option to suit every business.

-

After products have been received and passed a quality inspection, they need to be stored so that you can find them when you need them. This process is called putaway. The spot where you store a particular product is called a location. One section of a warehouse might have small locations for light items; another area may have large locations on the floor for heavy items.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved