- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- GL - Unearned / Deferred Revenue

GL - Unearned / Deferred Revenue

Unearned revenue is a liability to the entity until the revenue is earned. Learn the concept of unearned revenue, also known as deferred revenue. Gain an understanding of business scenarios in which organizations need to park their receipts as unearned. Look at some real-life examples and understand the accounting treatment for unearned revenue. Finally, look at how the concept is treated in the ERPs or automated systems.

What is unearned revenue?

Unearned revenues sometimes referred to as deferred revenues, are items that have been initially recorded as liabilities but are expected to become revenues over time or through the normal operations of the business. Unearned revenues (or deferred revenues) are revenues received in cash and recorded as liabilities prior to being earned. Unearned revenue is a liability to the entity until the revenue is earned.

Prepaid expenses and unearned revenues are created from transactions that involve the receipt or payment of cash. In both cases, the recording of the related expense or revenue is delayed until the end of the period or to a future accounting period as per accounting prudence and matching and accrual principles. It results from the company's receiving payments in advance for services or products that have not yet been provided. The company now ''owes'' that amount of services or products to its customer. This '' debt'' will be satisfied when those services or products are provided.

Examples of Unearned Revenue:

Some examples of unearned revenue are unearned rent, tuition received in advance by a school, an annual retainer fee received by an attorney, premiums received in advance by an insurance company, and magazine subscriptions received in advance by a publisher. Another example of unearned revenue would be if the customer paid a deposit for a custom ordered machine that has not been delivered, the deposit would be recorded as unearned revenue. A magazine subscription results in deferred revenue for the publisher because the payment is received in advance; it will be converted into actual revenue as issues of the magazine are delivered.

An airline that receives advance payment for tickets should also record the transactions as unearned revenue. Similarly, professional service providers such as accounting, legal, and contracting firms that accept deposits should record them as unearned revenue. Companies that provide warranties to their customers for an extended time period and charge for these warranties also deal with unearned incomes.

Accounting Treatment of Deferred Revenue:

Companies using the accrual accounting method should adhere to the revenue recognition principles and matching principles. Companies should recognize revenue only in the same accounting period in which it is earned. Consequently, when companies accept deposits or advance payments, they should record them as unearned revenues at the time of the receipt. Then, in the future when the goods or services are provided to the customers, they should adjust the entries as earned income.

Unearned revenue is treated as a short- or long-term (or both) liability on a company's balance sheet, based on the nature of the entry and underlying business contract. This type of adjusting entry will be adjusted by another entry as and when the revenue will be earned to recognize revenue and offset the deferred revenue.

Examples of industries having unearned revenue:

Unearned revenue can be applied in almost all industries however it becomes very important in the case of some industries where advance payments are the norm like subscriptions for magazines. Companies providing extended warranties need to treat their sales as unearned revenues at the time of sale.

Industries dealing in products that require installation services are accounted for as multiple-element arrangements, where the fair value of the installation service is deferred when the product is delivered and recognized when the installation is complete. For installations with customer acceptance provisions, all revenue is generally deferred until customer acceptance.

Warranty billings are generally invoiced to the customer at the beginning of the contract term. Revenue from extended warranties is deferred and recognized ratably over the duration of the contract. When a dealer sells (sells being the keyword) a service contract not all of the revenue is recognized at the time of sale. Instead, it is recognized over the life of the contract and recorded as Deferred Service Contract Revenue in the liability section of the balance sheet. Each month and or year a portion of the deferred revenue is moved from liabilities to income. Unearned extended warranty revenue is reflected as unearned revenues in accrued liabilities in the balance sheets.

Revenue from separately priced, self-insured service contracts is deferred at the point of sale and generally recognized on a straight-line basis over the life of the contract for GAAP presentation.

Accounting Entries for Unearned Revenue:

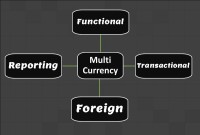

In automated systems, you can define rules that can determine the event which triggers the revenue recognition. Till the time that recognition event is triggered, the amount remains parked in an unearned revenue account as a liability. If you enter an invoice with a Bill in Advance invoicing rule, Receivables creates the following journal entries.

In the first period of the rule:

Debit: Receivables

Credit: Unearned Revenue

In all periods of the rule for the portion that is recognized:

Debit: Unearned Revenue

Credit: Revenue

Related Links

You May Also Like

-

In most of the automated financial systems, you can define more than 12 accounting periods in a financial year. This article will explain the concept of the adjustment period and the benefits of having adjustment periods. Adjustment periods have their inherent challenges for the users of financial statements and there is a workaround for those who don’t want to use adjustment periods.

-

This article explains the process of entering and importing general ledger journals in automated accounting systems. Learn about the basic validations that must happen before the accounting data can be imported from any internal or external sub-system to the general ledger. Finally, understand what we mean by importing in detail or in summary.

-

Business Metrics for Management Reporting

Business metric is a quantifiable measure of an organization's behavior, activities, and performance used to access the status of the targeted business process. Traditionally many metrics were finance based, inwardly focusing on the performance of the organization. Businesses can use various metrics available to monitor, evaluate, and improve their performance across any of the focus areas like sales, sourcing, IT or operations.

-

Functional Organizational Structures

A functional organizational structure is a structure that consists of activities such as coordination, supervision and task allocation. The organizational structure determines how the organization performs or operates. The term organizational structure refers to how the people in an organization are grouped and to whom they report.

-

Network Organizational Structures

The newest, and most divergent, team structure is commonly known as a Network Structure (also called "lean" structure) has central, core functions that operate the strategic business. It outsources or subcontracts non-core functions. When an organization needs to control other organizations or agencies whose participation is essential to the success, a network structure is organized.

-

The sole trader organization (also called proprietorship) is the oldest form of organization and the most common form of organization for small businesses even today. In a proprietorship the enterprise is owned and controlled only by one person. This form is one of the most popular forms because of the advantages it offers. It is the simplest and easiest to form.

-

As the business grows, the company may want to transition to a branch structure as branches are allowed to conduct a much broader range of activity than representative offices. Branches can buy and sell goods, sign contracts, build things, render services, and generally everything that a regular business can do. A company expands its business by opening up its branch offices in various parts of the country as well as in other countries.

-

The general ledger is the central repository of all accounting information in an automated accounting world. Summarized data from various sub-ledgers are posted to GL that eventually helps in the creation of financial reports. Read more to understand the role and benefits of an effective general ledger system in automated accounting systems and ERPs.

-

Matrix Organizational Structures

In recent times the two types of organization structures which have evolved are the matrix organization and the network organization. Rigid departmentalization is being complemented by the use of teams that cross over traditional departmental lines.

-

Generally Accepted Accounting Principles define the accounting procedures, and understanding them is essential to producing accurate and meaningful records. In this article we emphasize on accounting principles and concepts so that the learner can understand the “why” of accounting which will help you gain an understanding of the full significance of accounting.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved