- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- Company Form

Company Form

A Company (also called corporation) may be understood as an association of persons in which money is contributed by them, to carry on some business or undertaking. Persons who contribute the money are called the shareholders or the members of the company. A corporation is an artificial being, invisible, intangible and existing only in contemplation of law. Being the mere creature of law, it possesses only those properties which the charter of its creation confers upon it.

Definition of Company/Corporation

A Company (also called corporation) may be understood as an association of persons in which money is contributed by them, to carry on some business or undertaking. Persons who contribute the money are called the shareholders or the members of the company. A corporation is an artificial being, invisible, intangible and existing only in contemplation of law. Being the mere creature of law, it possesses only those properties which the charter of its creation confers upon it, either expressly or an incidental to its very existence. It is an association of many persons, who contribute money or money's worth to a common stock and employ it for a common purpose. The common stock so contributed is denoted in money and is the capital of the company. The persons who contribute it or to whom it belongs are members. The proportion of capital to which each member is entitled is his share.

Main Features

- Once incorporated, a company assumes the identity of an artificial person

- An incorporated company is a corporate body and by action of law it is treated as a legal person

- The company may sue or be sued by its members/shareholders

- The company can enter into contracts in its own name and likewise may sue and be sued in its own name

- The company is a separate legal entity distinct from its management and shareholders

- Company affairs are managed by a Board of Directors

- A company has perpetual existence and is not effected by the joining, leaving, death, insolvency or insanity of any of its shareholders

- The shares of a Joint Stock company (except private company) are freely transferable

- A private company through its articles may place certain restrictions on the transferability of its shares

- In case of a company limited by share, the liability of the members of the company is limited to the nominal value of

- shares held by them

- Capital for the company is contributed by a number of persons called shareholders

- Large number of shareholder give ability to company to raise large amount of capital

- Shareholder is not the agent of the company or its shareholders and hence he cannot bind company with his acts

- The scope of the business of a company is limited and restricted to what is mentioned in the 'object clause' of its Memorandum of Association. The company cannot take up any new business without changing the object clause.

To summarize shareholders are the real owners of the company, Their liability is limited. They can also transfer their shares to others. Since the shareholders are very large in number, the company cannot be managed by all. They elect a board of directors to manage the company. The destiny of the company is guided and directed by the directors. These directors employ some people to carry on the day-to-day business of the company.

Different types of companies

Statutory Company: A company established by a special Act of the Parliament or State Legislature is called 'Statutory Company'. Such companies are established in special cases when it is necessary to regulate the working of the company for some specific purposes. Examples of such corporations are Central Banks etc.

Chartered Company: A company which is incorporated under a special Royal Charter granted by the Monarch is called a 'Chartered Company'. It is regulated by the provisions of that charter. Examples are: British East India Company, Bank of England, Hudson's Bay Company, etc.

Unlimited Company: A company in which the liability of the members is unlimited, is called 'Unlimited Company'. At the time of winding up of the company shareholders have to pay, if necessary, from their personal assets to clear the company's debts. Such companies are very rare.

Companies Limited by Guarantee: In the case of some companies, members give guarantee for the debts of the company up to a certain limit in addition to the amount of shares held by them. The additional amount guaranteed by the members is, generally, laid down in the Memorandum of Association. Such companies are not formed for the purpose of profit. They are formed to promote art, culture, religion. trade, sports, etc. Clubs, Charitable organizations, trade association, etc. come under this category.

Companies Limited by Shares: In this case the liability of the members is limited to the amount of the shares held by them. A shareholder can be called upon to pay only the unpaid amount of shares held by him and nothing more. Most of the companies come under this category.

Private Limited Company: A private limited company means a company which by its article restricts the right to transfer its shares; limits the number of its members; and prohibits any invitation to the public to subscribe for any shares or debentures of the company.

Public Limited Company: A public limited company is one which is not a private limited company. The right of the shareholder to transfer his shares is not restricted and it can invite public to subscribe for its shares and debentures.

Government Company: A company in which not less than 5 1 per cent of the paid up share capital is held by the Central Government, or by any State Government or jointly by Central and/or State Governments.

National Company: When the operations of a company are confined within the boundaries of the country in which it is registered, such a company is called a national company.

Multinational Company: When the operations of a company are extended beyond the boundaries of the country in which it is registered, such a company is called a multinational company. It is also called 'transnational company'.

Foreign Company: Foreign Company refers to a company that operates in the foreign country outside the country of its registration.

Holding and Subsidiary Company: A subsidiary is a company that is completely or partly owned by another company known as holding company.

Related Links

You May Also Like

-

Matrix Organizational Structures

In recent times the two types of organization structures which have evolved are the matrix organization and the network organization. Rigid departmentalization is being complemented by the use of teams that cross over traditional departmental lines.

-

GL - Different Accounting Methods

The accounting method refers to the rules a company follows in reporting revenues and expenses. Understand the two common systems of bookkeeping, single, and double-entry accounting systems. Learners will also understand the two most common accounting methods; cash and accrual methods of accounting and the advantages and disadvantages of using them.

-

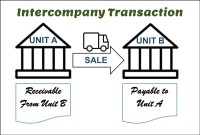

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

-

Prepayments and Prepaid Expenses

Prepayments are the payment of a bill, operating expense, or non-operating expense that settle an account before it becomes due. Learn the concept of prepaid expenses. Understand the accounting treatment for prepaid expenses. Understand the concept by looking at some practical examples and finally learn the adjusting entry for these expenses.

-

Reversing Journals are special journals that are automatically reversed after a specified date. A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries. See an example of reversing journal entry!

-

General Ledger - Advanced Features

Modern automated general ledger systems provide detailed and powerful support for financial reporting and budgeting and can report against multiple legal entities from the single system. These systems offer many advanced functionalities right from journal capture to advanced reporting. This article will provide an overview of some advanced features available in today's General Ledgers.

-

Concept of Representative Office

A representative office is the easiest option for a company planning to start its operations in a foreign country. The company need not incorporate a separate legal entity nor trigger corporate income tax, as long as the activities are limited in nature.

-

GL - Journal Posting and Balances

In this tutorial, we will explain what we mean by the posting process and what are the major differences between the posting process in the manual accounting system compared to the automated accounting systems and ERPs. This article also explains how posting also happens in subsidiary ledgers and subsequently that information is again posted to the general ledger.

-

GL - Recurring Journal Entries

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Learn the various methods that can be used to generate recurring journals. See some examples and explore the generic process to create recurring journals in any automated system.

-

A joint venture (JV) is a business agreement in which the parties agree to develop, for a finite time, a new entity and new assets by contributing equity. They exercise control over the enterprise and consequently share revenues, expenses and assets. A joint venture takes place when two or more parties come together to take on one project.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved