- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

Float

To understand cash management, one must understand FLOAT. Float is the most critical component in Cash Management. Learn about cash float in this article.

Float is the most critical component in Cash Management

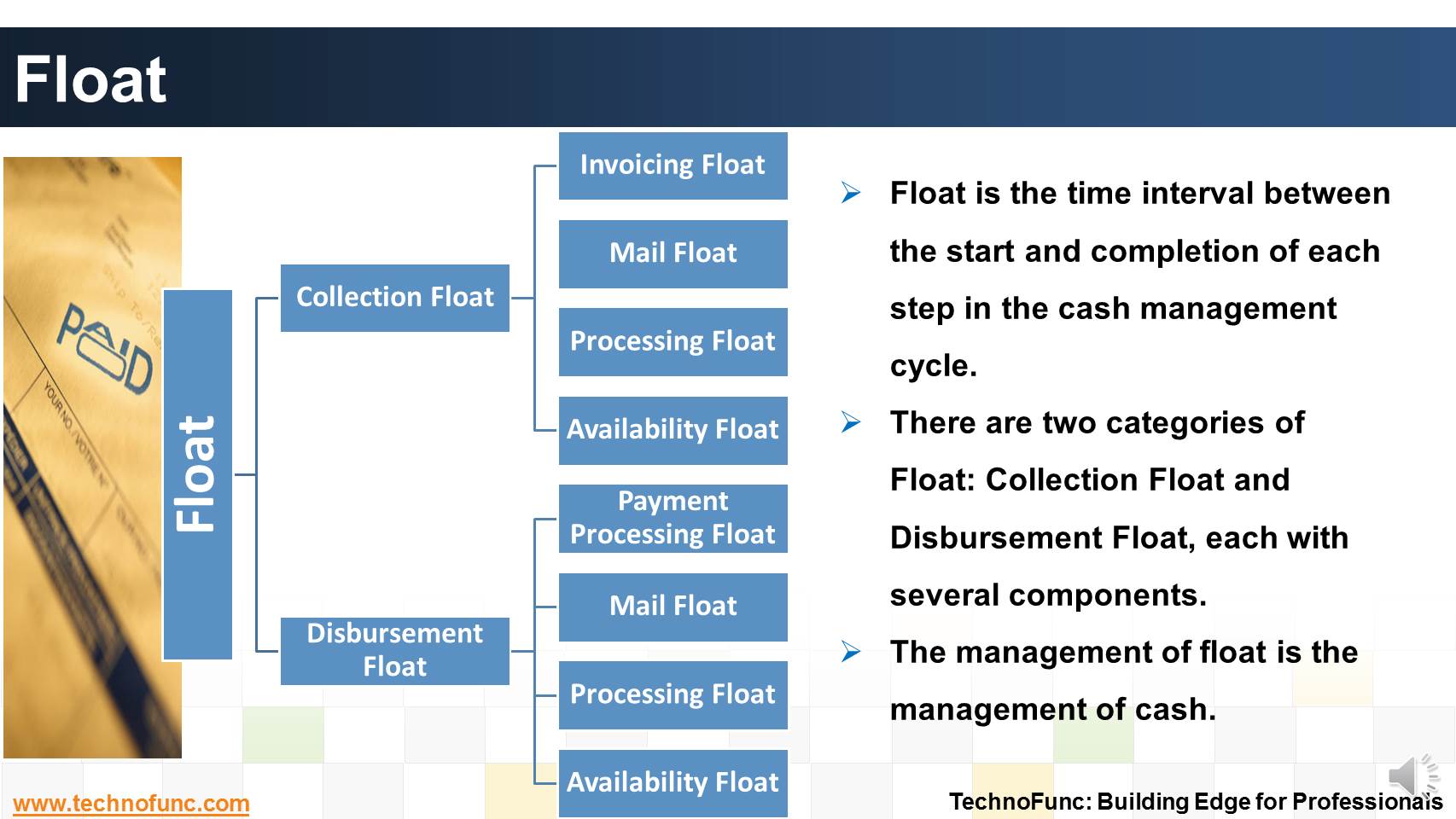

Float is the time interval between the start and completion of each step in the cash management cycle.

The management of float is the management of cash.

Each cash management system is designed to improve the flow of cash by accelerating the collection of funds and extending the disbursement float.

There are two categories of Float:

- Collection Float

- Disbursement Float, each with several components.

Related Links

You May Also Like

-

In the previous article we talked about the meaning of the account reconciliations. Now as you now the definition of account reconciliation, in this article let us see why it is carried out.

-

Many different accounts are used in finance. Understand the representation and nature of clearing account in context of accounting, finance and ERP Systems.

-

Introduction to Cash Clearing Process

Unravel the mystery behind clearing accounts. Learn why clearing accounts are used in finance and accounting. Learn why so many clearing accounts are defined in ERPs and Automated Accounting Systems.

-

Suspense and clearing accounts resemble each other in many respects but there exists important fundamental difference between the two. Read more to explore these differences.

-

Before we dive into cash management, let us fist understand what we mean by cash and what constitutes cash in context of cash management process.

-

Although there is no straight forward answer to the question, how to best organize a treasury function, this article provides an generic view of the way large MNCs creates departments or sub-functions within the treasury function.

-

So many codes in the lines that are there in a Bank Statement. It contain lots and lots of meaningful information that can help automated many tasks. Explore more!

-

Treasury has increasingly become a strategic business partner across all areas of the business, adding value to the operating divisions of the company. Managing activities that were traditionally carried out within the general finance function. Learn about the drivers for this change.

-

In manual clearing, Bank statement details are to be matched manually considering certain rules. Learn the steps involved in manual clearing of bank transactions.

-

Have you ever wondered what is actually a Bank Statement and why it is needed. What is the information that is available in a bank statement?

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved