- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- Order to Cash

- Collection Float

Collection Float

Collection Float is the time spent to collect receivables. Collection float is the sum total of time taken by Invoice Float; Mail Float; Processing Float and Availability Float. Explore more!

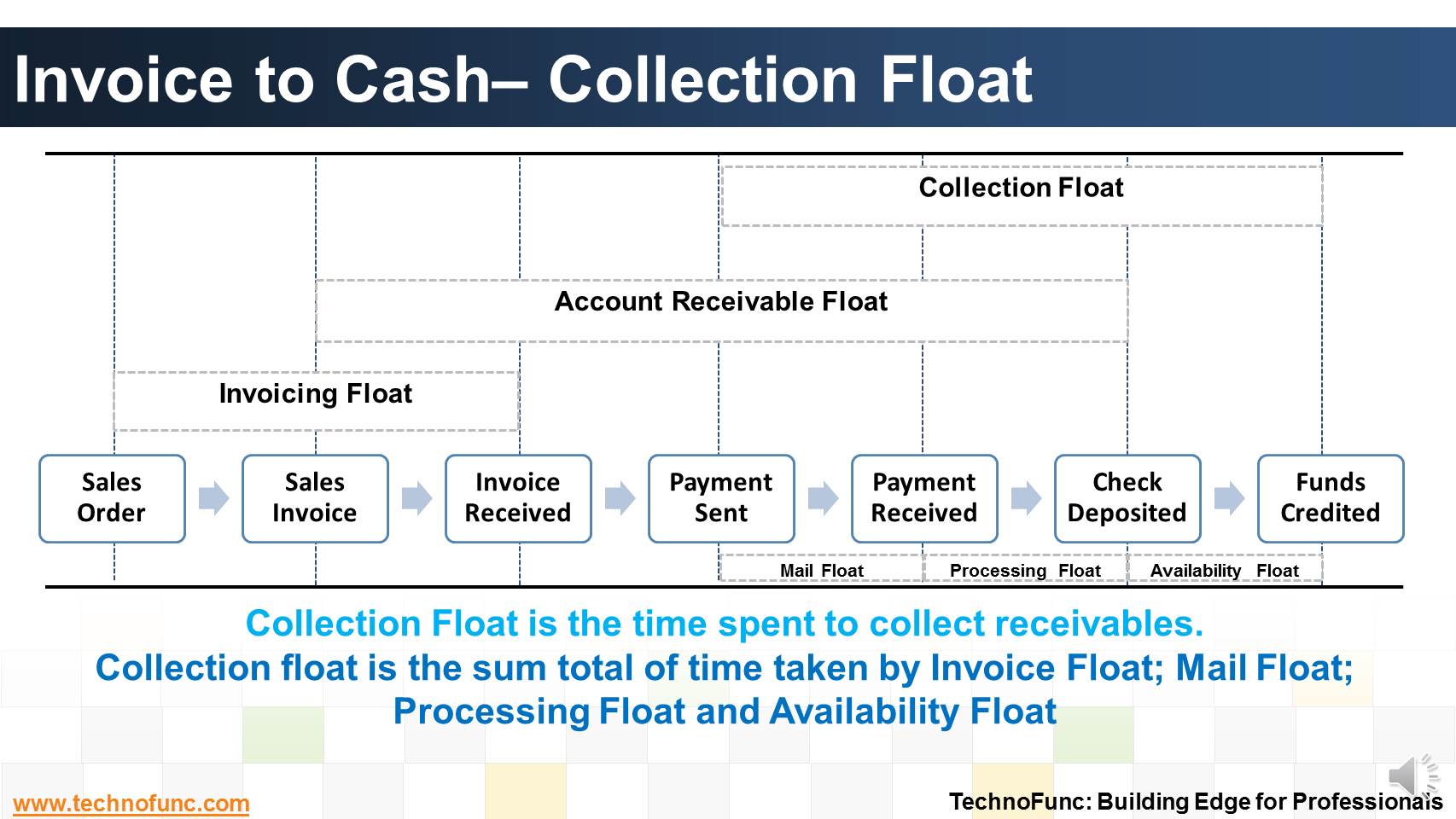

Invoice to Cash– Collection Float

Collection Float is the time spent to collect receivables.

Collection float is the sum total of time taken by Invoice Float; Mail Float; Processing Float and Availability Float

1. Invoicing float is the time period between the delivery of goods or services to the customer and the customer's receipt of the bill, generally by mail. It is the time it takes a company to record its delivery of service or

goods and then to produce and mail a bill.

2. Mail float is the time taken by Postal or Courier Service to deliver the customer's payment.

3. Processing float is the period between the receipt of the payment and its deposit into the company's bank account and includes the time it takes to record the payment in the accounting system.

4. Availability float is the time it takes the deposited check to clear the customer's account and for good funds to be available to the company for disbursement.

Related Links

You May Also Like

-

Unravel the mystery behind clearing. Why we use clearing accounts. Find the relevance of word "Clearing" in business context.

-

Collection Float is the time spent to collect receivables. Collection float is the sum total of time taken by Invoice Float; Mail Float; Processing Float and Availability Float. Explore more!

-

Complete Bank Reconciliation Process

Bank Reconciliation Process is a eight step process starting from uploading the Bank Statement to finally posting the entries in General Ledger. Learn the Eight Steps in Detail!

-

The Cash Management component ensures that the enterprise has sufficient liquidity for payments that are due and to monitor payment flows. Learn how treasury plays an important role in cash management for the enterprise.

-

Treasury has increasingly become a strategic business partner across all areas of the business, adding value to the operating divisions of the company. Managing activities that were traditionally carried out within the general finance function. Learn about the drivers for this change.

-

What is Account Reconciliation?

Before you understand the Bank Reconciliation Process it is important to understand what is account reconciliation and why it is carried out.

-

So many codes in the lines that are there in a Bank Statement. It contain lots and lots of meaningful information that can help automated many tasks. Explore more!

-

Treasury Management - Functions

Treasury management has become an specialized function. Treasury function helps in managing the Risk-return profile as well as the tax-efficiency of investment instruments. In larger firms, it may also include trading in bonds, currencies and financial derivatives. Learn about the various tasks, activities and imperatives, undertaken by treasuries in in today's context.

-

Learning objectives for this lesson are: Meaning of Order to Cash Process; Sub Processes under Order to Cash; Process Flow for Order to Cash; Key Roles & Transactions; Key Setups/Master Data Requirements.

-

Cash Management - Integrations

Cash Management integrates cash transactions from various sources like Receivables, Payables, Treasury and creates reconciliation accounting entries after matching transactions with Bank Statements.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved