- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- Cash Management

- Disbursement Float

Disbursement Float

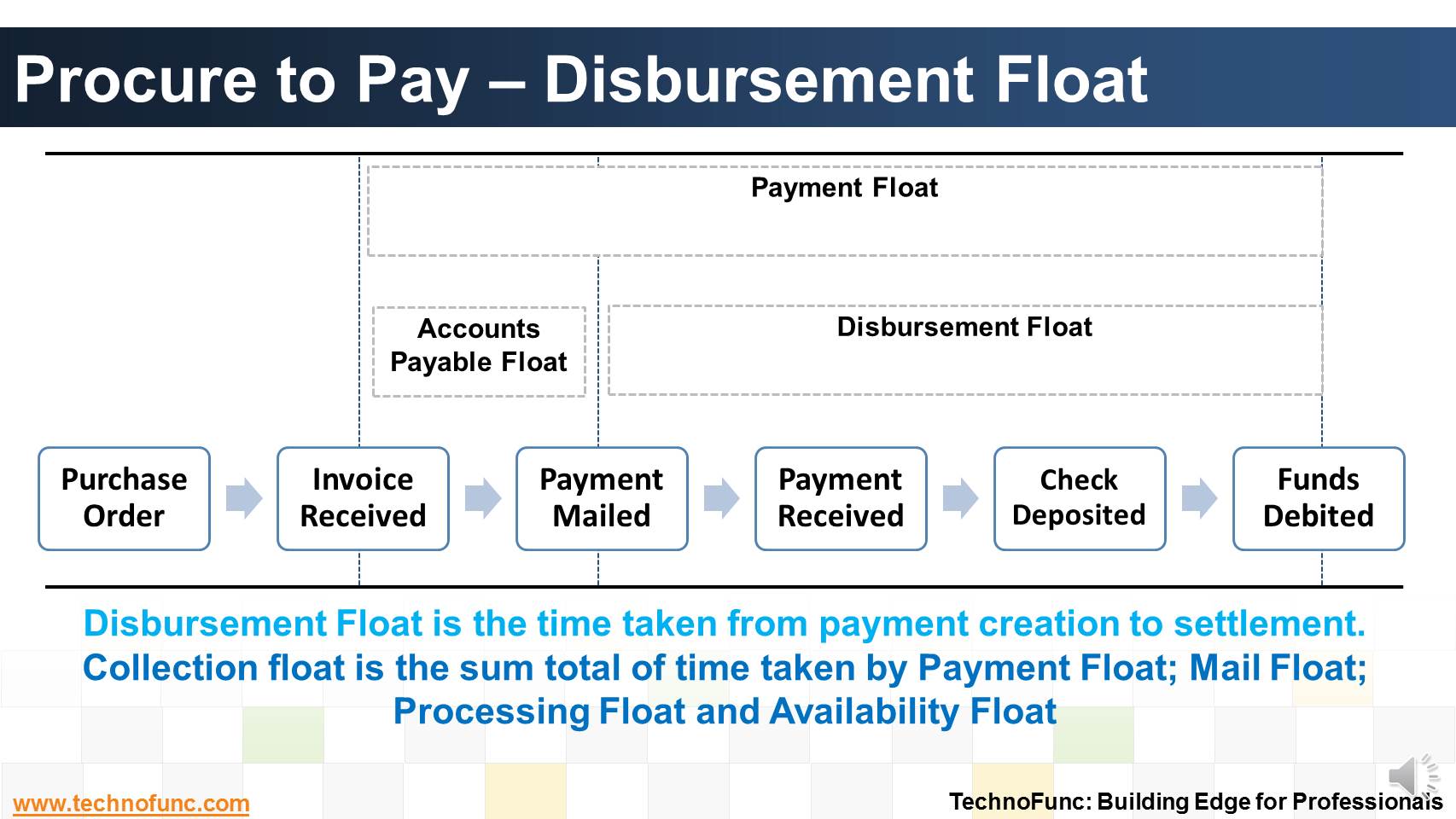

Disbursement Float is the time taken from payment creation to settlement. Collection float is the sum total of time taken by Payment Float; Mail Float; Processing Float and Availability Float. Learn more!

Disbursement Float is the time it takes a company's payment to be created, mailed, received, deposited and presented to the drawee bank for settlement.

Thus collection float and disbursement float refer to the same processes and time intervals depending on point of view; one as a customer and another as a supplier.

For the company receiving a payment, collection float represents the time it takes an invoice to be prepared, to reach the customer, to receive payment and for the payment to clear the bank.

For the company making the payment, that same interval is disbursement float.Disbursement float consists of the following four components:

1. Invoicing and payment processing float includes both the time it takes the supplier to prepare and send the invoice, as well as the time the accounts payable department requires to process the invoice and create the payment.

2. Mail float is the time taken by postal or courier service to deliver the payment to the vendor.

3. Processing float is the time it takes the vendor to record the payment and deposit it into the bank.

4. Availability float is the time it takes the bank to clear the check and deduct the funds from the payee's bank balance.

Cash management focuses on shortening collection float and extending disbursement float, without impacting the positive customer and vendor relationships.

The skillful management of float contributes real bottom-line impact and benefit to the company.

Related Links

You May Also Like

-

The objective of Financial risk management is to protect assets and cash flows from any risk. Treasury function works to accurately assess financial risks by identifying financial exposures including foreign exchange, interest rate, credit, commodity and other enterprise risks. Learn about the various risks that are managed by treasury.

-

So many codes in the lines that are there in a Bank Statement. It contain lots and lots of meaningful information that can help automated many tasks. Explore more!

-

Before we dive into cash management, let us fist understand what we mean by cash and what constitutes cash in context of cash management process.

-

Learning objectives for this lesson are: Meaning of Order to Cash Process; Sub Processes under Order to Cash; Process Flow for Order to Cash; Key Roles & Transactions; Key Setups/Master Data Requirements.

-

Account Reconciliation – How? Learn the three key attributes to perfom account reconciliation.

-

The topic for this lesson is "Introduction to Cash Management Process". We start with the learning objectives for building requisite functional expertise in cash management process.

-

Treasury Management - Functions

Treasury management has become an specialized function. Treasury function helps in managing the Risk-return profile as well as the tax-efficiency of investment instruments. In larger firms, it may also include trading in bonds, currencies and financial derivatives. Learn about the various tasks, activities and imperatives, undertaken by treasuries in in today's context.

-

Technology has enabled the treasury function by providing various solutions to manage it's complicated tasks. This article explains various types of treasury management systems available in the market.

-

In manual clearing, Bank statement details are to be matched manually considering certain rules. Learn the steps involved in manual clearing of bank transactions.

-

In the previous article we talked about the meaning of the account reconciliations. Now as you now the definition of account reconciliation, in this article let us see why it is carried out.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved