- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- GL - Accrued Expenses

GL - Accrued Expenses

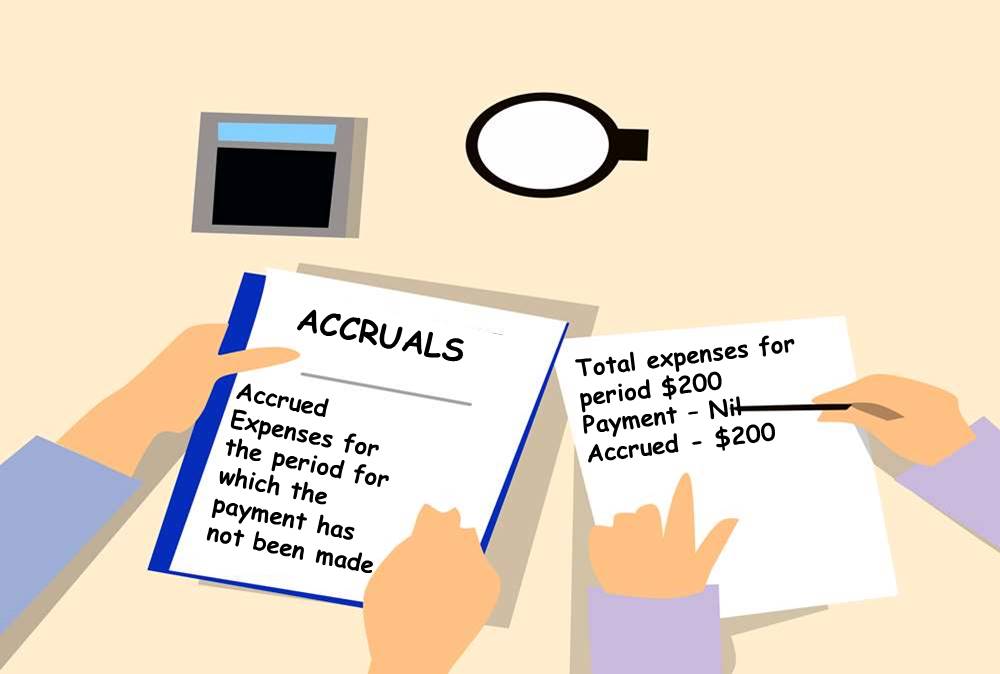

Accrued expenses, sometimes referred to as accrued liabilities, are expenses that have been incurred but have not been recorded in the accounts. Discuss the need to record accrued liabilities and why they require an adjustment entry. Understand the treatment for these entries once the accounting period is closed and learn to differentiate when the commitments become liabilities.

What are Accrued Expenses?

Accrued expenses, sometimes referred to as accrued liabilities, are expenses that have been incurred but have not been recorded in the accounts. Accrued expenses are expenses that have already been incurred, that the resulting benefit has been received by the business and we have a legal or moral obligation to pay the other party, but not yet paid or recorded. Examples of these types of adjusting entries could be for payroll that has been earned by employees on the last day of the period but not paid until the next payroll date. Other examples include accrued interest on notes payable and accrued taxes.

What is Accrued Liability?

The accrued liability is a liability that was incurred, but for which payment is not yet made, during a given accounting period. Some examples include wages owed and taxes payable. Accrued payroll is an example of accrued expense/liabilities – usually represented in a separate account, which represents the amount earned by employees but not yet paid to them. Since employees are typically paid for time already worked, not in advance, every company has some amount of compensation earned by its employees but not yet paid to them. The only exception would be those companies that pay employees on the last day of their workweek, in which case at the end of a payday they would not owe any money to their employees, until the following day.

Why record accrued expenses and liabilities?

When a company keeps its accounting records on an accrual basis, such liabilities are recorded when they become owed, even though they don't actually have to be paid until later on. The amount of such an accrued but unpaid item at the end of the accounting period is both an expense and a liability. These may be expenses the company has incurred, but for which it has not yet received an invoice to record. In order to make sure the expense gets recorded into the right accounting period, the company's accountants will accrue the liability rather than wait for an invoice to arrive or a check to be issued. Examples might include large purchases for which the supplier has not yet invoiced the company or interest expense on a loan that doesn't get invoiced, but for which the bank will automatically charge the company. This adjusting entry is necessary so that expenses are properly matched to the period in which they were incurred.

Example of Accrued Expenses:

A company gets into an agreement to borrow $2 million from an investment company for six months payable along with interest @2% per month, after six months. The loan was advanced on November, 1 and the company follows the regular accounting calendar from Jan to Dec every year. The amount was repaid on 1st May along with an interest of $240000.

As the company closes its books for the accounting year on December 31, on that date the company will not have an invoice or payment for the interest that the company is incurring. (The reason is that all of the interest will be due on 1st May next year). Without an adjusting entry to accrue the interest expense that the company has incurred for the two months November and December, the company’s financial statements as of December 31 will not be reporting the $80,000 of interest (Interest @2% for 2 months) that the company has incurred in December. In order for the financial statements to be correct on the accrual basis of accounting, the accountant needs to record an adjusting entry dated as of December 31. The adjusting entry will consist of a debit of $80,000 to Interest Expense Account (Expense Accrual) and a credit of $80,000 to Interest Payable (Liability Accrual).

What happens to these entries when amounts are paid?

These types of accrual entries generally reverse next month. To simplify the subsequent recording of the following period’s transactions, some accountants use what is known as reversing entries for certain types of adjustments. Reversing entries can be automated in ERPs and discussed and illustrated in a separate article in this section.

Why accrued expenses result in adjusting entry?

Accrued revenues and expenses are created by unrecorded revenue that has been earned or an unrecorded expense that has been incurred. As the cash outlay has not happened in both these cases, we need to pass an adjustment entry at the end of the accounting period to record these expenses into books of accounts. Prior to recording the adjusting entries, neither accrued revenues nor accrued expenses would have been recorded.

When to convert commitments to Accrued Liability?

Expenses do not get recorded when they are committed when the order is called in when a purchase order is issued, or even when the supplier agrees to supply the goods or services ordered. All those things are simply requests or promises, all of which can be rescinded without penalty. So they're not the irrevocable transactions that we can record. When the supplier acts on that promise to deliver, then we have an accounting event that should be recorded and the money is really spent.

Today, many companies have integrated enterprise accounting systems that can keep track of purchase orders issued but not yet fulfilled, and it's much easier to track and report commitments made for future goods and services. Even so, such commitments cannot be booked as actual expenses until the goods have been delivered and the purchase order satisfied. With that overview in mind, under accrual systems accountants need to book expenses that have already been incurred.

Related Links

You May Also Like

-

A legal entity is an artificial person having separate legal standing in the eyes of law. A Legal entity represents a legal company for which you prepare fiscal or tax reports. A legal entity is any company or organization that has legal rights and responsibilities, including tax filings.

-

Accrued expenses, sometimes referred to as accrued liabilities, are expenses that have been incurred but have not been recorded in the accounts. Discuss the need to record accrued liabilities and why they require an adjustment entry. Understand the treatment for these entries once the accounting period is closed and learn to differentiate when the commitments become liabilities.

-

In this article we will help you understand the double-entry accounting system and state the accounting equation and define each element of the equation. Then we will describe and illustrate how business transactions can be recorded in terms of the resulting change in the elements of the accounting equation.

-

GL - Different Accounting Methods

The accounting method refers to the rules a company follows in reporting revenues and expenses. Understand the two common systems of bookkeeping, single, and double-entry accounting systems. Learners will also understand the two most common accounting methods; cash and accrual methods of accounting and the advantages and disadvantages of using them.

-

A Company (also called corporation) may be understood as an association of persons in which money is contributed by them, to carry on some business or undertaking. Persons who contribute the money are called the shareholders or the members of the company. A corporation is an artificial being, invisible, intangible and existing only in contemplation of law. Being the mere creature of law, it possesses only those properties which the charter of its creation confers upon it.

-

GL - Understanding Chart of Accounts

A chart of accounts (COA) is a list of the accounts used by a business entity to record and categorize financial transactions. COA has transitioned from the legacy accounts, capturing just the natural account, to modern-day multidimensional COA structures capturing all accounting dimensions pertaining to underlying data enabling a granular level of reporting. Learn more about the role of COA in modern accounting systems.

-

The purpose of the general ledger is to sort transaction information into meaningful categories and charts of accounts. The general ledger sorts information from the general journal and converts them into account balances and this process converts data into information, necessary to prepare financial statements. This article explains what a general ledger is and some of its major functionalities.

-

General Ledger - Advanced Features

Modern automated general ledger systems provide detailed and powerful support for financial reporting and budgeting and can report against multiple legal entities from the single system. These systems offer many advanced functionalities right from journal capture to advanced reporting. This article will provide an overview of some advanced features available in today's General Ledgers.

-

Five Core General Ledger Accounts

Typically, the accounts of the general ledger are sorted into five categories within a chart of accounts. Double-entry accounting uses five and only five account types to record all the transactions that can possibly be recorded in any accounting system. These five accounts are the basis for any accounting system, whether it is a manual or an automated accounting system. These five categories are assets, liabilities, owner's equity, revenue, and expenses.

-

Global Business Services (GBS) Model

Global business services (GBS) is an integrated, scalable, and mature version of the shared services model. Global Business Services Model is a result of shared services maturing and evolving on a global scale. It is represented by the growth and maturity of the Shared services to better service the global corporations they support.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved