- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- GL - Journal Entry & Import

GL - Journal Entry & Import

This article explains the process of entering and importing general ledger journals in automated accounting systems. Learn about the basic validations that must happen before the accounting data can be imported from any internal or external sub-system to the general ledger. Finally, understand what we mean by importing in detail or in summary.

Recording Journals in General Ledger:

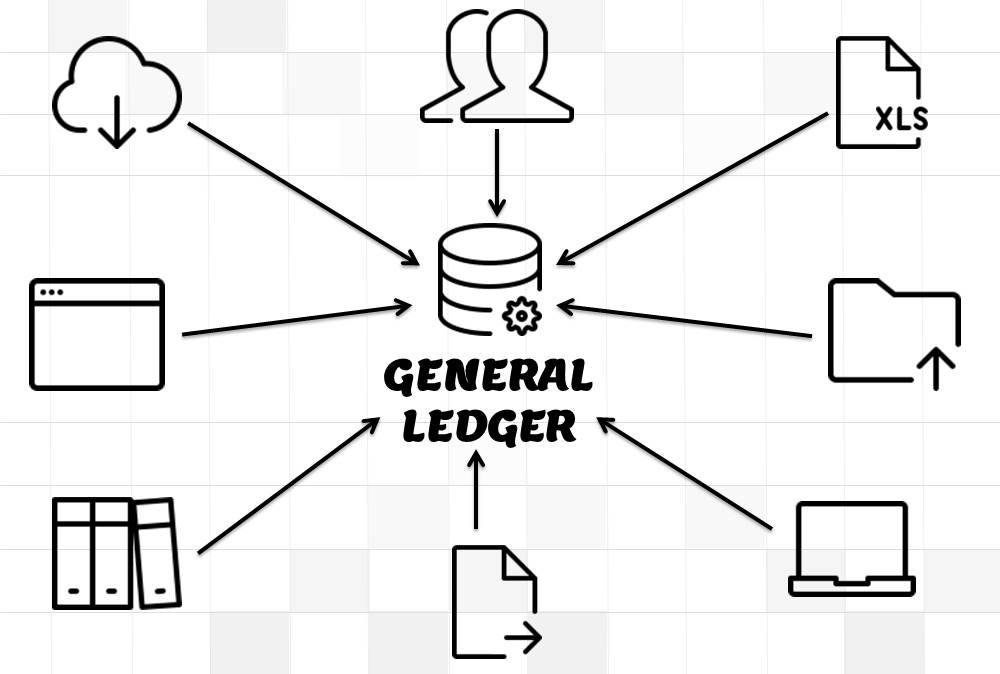

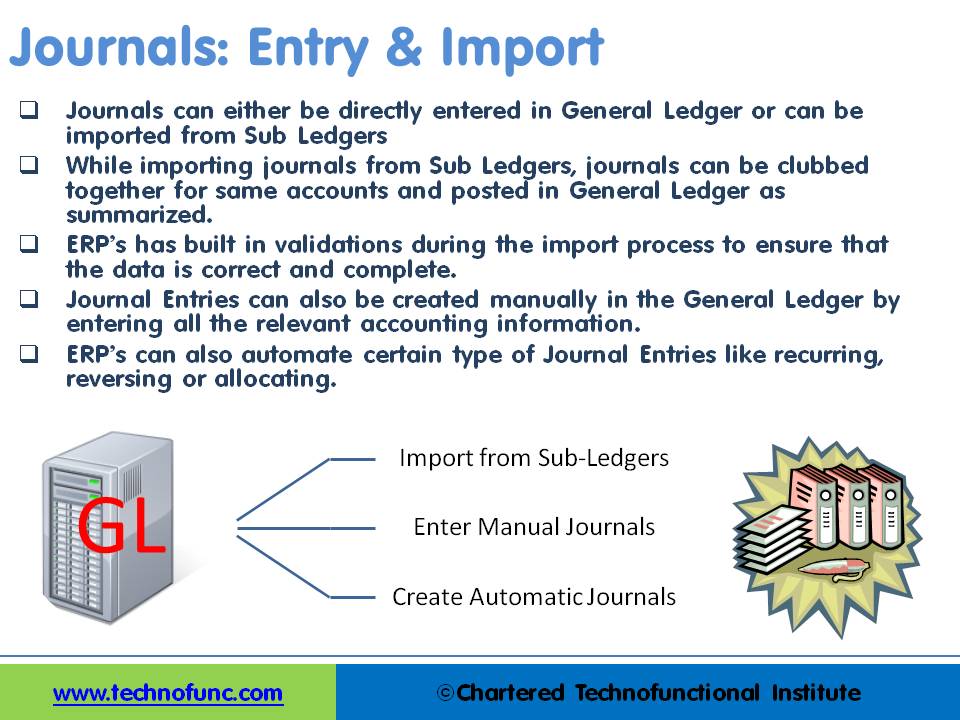

Journals can either be directly entered in General Ledger or can be imported from Sub Ledgers. Most of the journals are created along-with business transactions like sales, purchases, receipts, and payments and get recorded in respective sub-ledgers. As sub-ledgers generally capture data at a more granular level, the relevant accounting information must flow to the general ledger for posting and subsequent reporting. From sub-ledgers, they need to be imported to the general ledger for financial recording and reporting.

Journal Entries can also be created manually in General Ledger by entering all the relevant accounting information. ERPs can also automate certain types of Journal Entries like recurring, reversing, or allocating journals. In case of manual entry follow the steps and guidelines outlined in the Recording Journals tutorial.

Importing – Detail V/s Summarized:

While importing journals from Sub Ledgers, journals can be clubbed together for the same accounts and posted in General Ledger as summarized.

Various general ledger systems provide the functionality to create Summary Journals which summarize all transactions for the same account, period, and currency into one debit or credit journal line. This results in fewer transactions in the general ledger systems and makes financial reports more manageable in size. In the case of summary journal users, lose the one-to-one mapping of detail transactions in the sub-ledger to the summary journal lines created by the import process. However most of the organizations use this feature as this prevents too many transactions in GL Accounts and transactions get clubbed based on category, type, or transaction source.

Using the drill-down functionalities available in most of the modern general ledger systems, users can still perform various review and analysis functions, as even if the system creates summary journals, it can still maintain a mapping of how Journal Import summarizes sub-ledger detail transactions from feeder systems into general ledger journal lines.

Journal Import Validations:

ERP’s and automated accounting systems must have built in validations during the import process to ensure that the data is correct and complete. An effective Journal Import program should validate key accounting information before it creates journal entries in the General Ledger application to prevent errors and reconciliation efforts.

Given below are some of the common data validations that can happen during the GL Import process:

1. Suspense Posting:

Suspense posting puts the remaining amount in the suspense account in case the debits and credits of the journal are not matching. In case it is not required, Journal Import should reject all invalid lines that do not balance.

2. Duplicate Batch Name:

If the batch name is a unique field then Journal Import should ensure that a batch with the same name does not already exist for the same period in the General Ledger application. Similarly, it must also check to ensure that more than one journal entry with the same name does not exist for a batch.

3. Other Attributes:

Attributes that can be validated to ensure that journals contain the appropriate accounting data could be accounting books, period, source, currency, category, accounting date, reversal period, account validation, account code combinations, effective date, roll date, and any other required validations.

Import Using Excel:

In today’s accounting world, financial and operational data typically is stored in a variety of programs and formats. Excel is one of such tools, most widely used by the accountants! When accountants need to prepare a report based on data from various systems, the first step is to export the data into Excel. Many times accounting information is stored in chronological order in excels by the accountants, and examples include adjusting entries and recurring entries.

Benefits of using the excel upload feature are that it makes life much easier for data operator and accounts executives. The great flexibility of excel based application increases productivity and results in reduced training costs as most users are already familiar with the excel functionalities and also improves user acceptance for automated systems. The biggest benefit comes from the fact that excel upload can also work in disconnected environments.

Typically, most of the automated systems provide the functionality to import accounting data from Excel to the general ledger and create journals. Most ERPs provide the ability to upload journals using the MS Excel worksheet. You can create journals in Excel Template and upload directly to General Ledger.

Related Links

You May Also Like

-

In every journal entry that is recorded, the debits and credits must be equal to ensure that the accounting equation is matched. In this article, we will focus on how to analyze and recorded transactional accounting information by applying the rule of credit and debit. We will also focus on some efficient methods of recording and analyzing transactions.

-

In this article we will help you understand the double-entry accounting system and state the accounting equation and define each element of the equation. Then we will describe and illustrate how business transactions can be recorded in terms of the resulting change in the elements of the accounting equation.

-

Defining Organizational Hierarchies

A hierarchy is an ordered series of related objects. You can relate hierarchy with “pyramid” - where each step of the pyramid is subordinate to the one above it. One can use drill up or down to perform multi-dimensional analysis with a hierarchy. Multi-dimensional analysis uses dimension objects organized in a meaningful order and allows users to observe data from various viewpoints.

-

Global Business Services (GBS) Model

Global business services (GBS) is an integrated, scalable, and mature version of the shared services model. Global Business Services Model is a result of shared services maturing and evolving on a global scale. It is represented by the growth and maturity of the Shared services to better service the global corporations they support.

-

Reversing Journals are special journals that are automatically reversed after a specified date. A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries. See an example of reversing journal entry!

-

General Ledger - Advanced Features

Modern automated general ledger systems provide detailed and powerful support for financial reporting and budgeting and can report against multiple legal entities from the single system. These systems offer many advanced functionalities right from journal capture to advanced reporting. This article will provide an overview of some advanced features available in today's General Ledgers.

-

Period End Accruals, Receipt Accruals, Paid Time-Off Accruals, AP Accruals, Revenue Based Cost Accruals, Perpetual Accruals, Inventory Accruals, Accruals Write Off, PO Receipt Accrual, Cost Accrual, etc. are some of the most complex and generally misconstrued terms in the context of general ledger accounting. In this article, we will explore what is the concept of accrual and how it impacts general ledger accounting.

-

Explore the concept of journal reversals and understand the business scenarios in which users may need to reverse the accounting entries that have been already entered into the system. Understand the common sources of errors resulting in the reversal of entries and learn how to correct them. Discuss the reversal of adjustment entries and the reversal functionalities in ERPs.

-

Trial Balance in General Ledger

One of the greatest benefits of using a double-entry accounting system is the capability to generate a trial balance. What do we mean by trial balance? As the name suggests a trial balance is a report that must have its debits equals to credits. Understand the importance of trial balance and why it is balanced. Learn how it is prepared and in which format.

-

Different Types of Organizational Structures

Modern business organizations run multiple product and service lines, operate globally, leverage large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved