- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- Cash Management

- What is a Bank Statement?

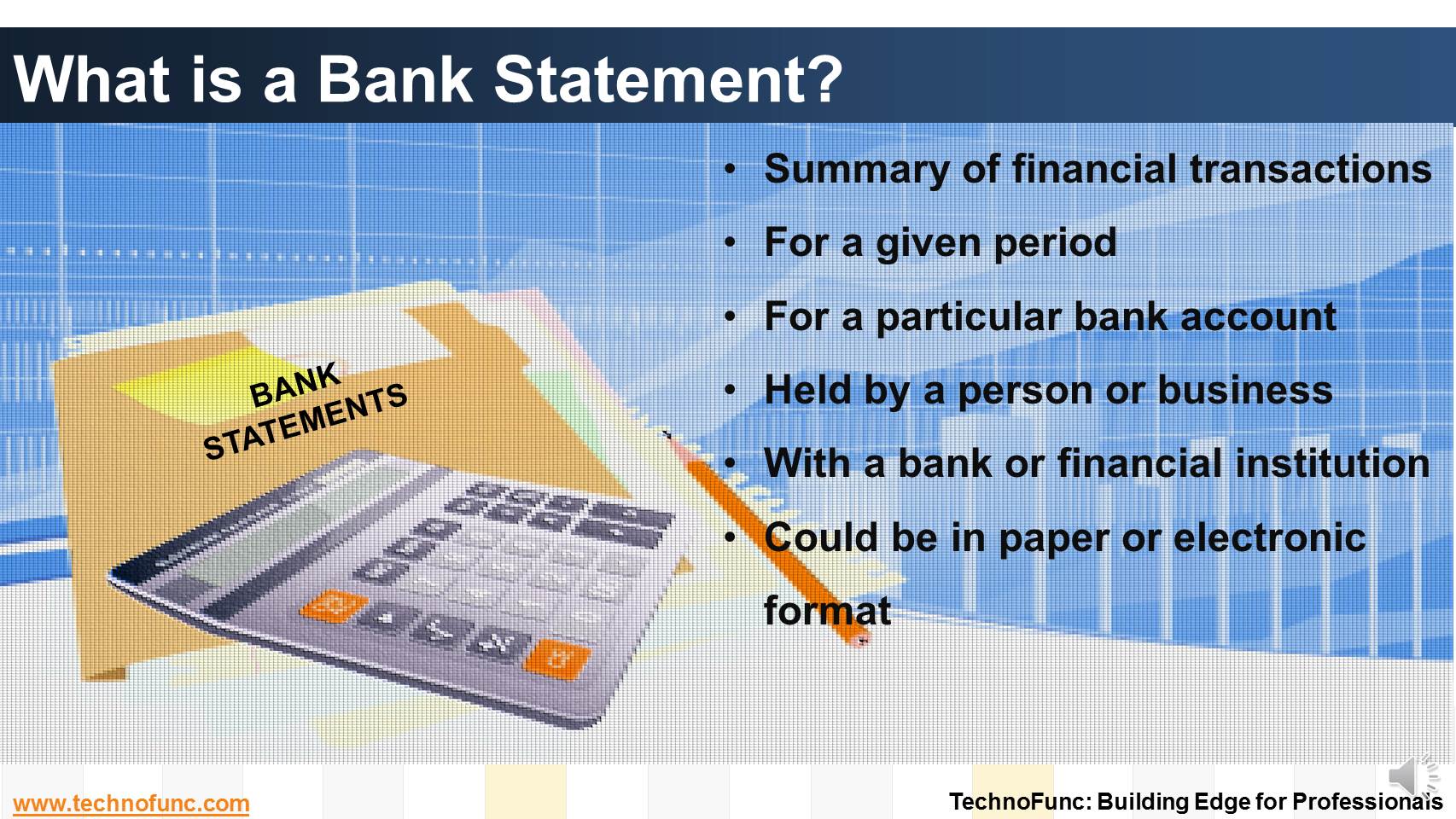

What is a Bank Statement?

Have you ever wondered what is actually a Bank Statement and why it is needed. What is the information that is available in a bank statement?

Bank statement or account statement is a summary of financial transactions which have occurred over a given period on a bank account held by a person or business with a financial institution.

Bank statements have historically been and continue to be typically printed on one or several pieces of paper

They are either mailed directly to the account holder, or kept at the financial institution's local branch for pick-up.

In recent years there has been a shift towards paperless, electronic statements

Most financial institutions now offer direct download of bank statement into account holders accounting software.

Key Attributes of Bank Statement:

- Summary of financial transactions

- For a given period

- For a particular bank account

- Held by a person or business

- With a bank or financial institution

- Could be in paper or electronic format

Related Links

You May Also Like

-

In the previous article we talked about the meaning of the account reconciliations. Now as you now the definition of account reconciliation, in this article let us see why it is carried out.

-

Treasury has increasingly become a strategic business partner across all areas of the business, adding value to the operating divisions of the company. Managing activities that were traditionally carried out within the general finance function. Learn about the drivers for this change.

-

What is Invoice to Cash Process

In this article, we will explore the business process area known as; Invoice to Cash; Also known as I2C. Learning objectives for this lesson are: Meaning of Invoice to Cash Process; Sub Processes under Invoice to Cash; Process Flow for Invoice to Cash; Key Transactions Fields; Key Setups/Master Data Requirements.

-

What is Account Reconciliation?

Before you understand the Bank Reconciliation Process it is important to understand what is account reconciliation and why it is carried out.

-

What are the various sources of cash in an organization. Which sources increase the cash available with the enterprise and which sources results in outflow of the cash? Let us explore!

-

So many codes in the lines that are there in a Bank Statement. It contain lots and lots of meaningful information that can help automated many tasks. Explore more!

-

Bank reconciliation process is targeted to validate the bank balance in the general ledger and explain the difference between the bank balance shown in an organization's bank statement. Learn the reasons for existence of differences between the two.

-

The Cash Clearing process enables you to track amounts that have actually cleared your bank. Till reconciliation happens the amounts are parked in 'Cash Clearing Account'.

-

Many different accounts are used in finance. Understand the representation and nature of clearing account in context of accounting, finance and ERP Systems.

-

The objective of Financial risk management is to protect assets and cash flows from any risk. Treasury function works to accurately assess financial risks by identifying financial exposures including foreign exchange, interest rate, credit, commodity and other enterprise risks. Learn about the various risks that are managed by treasury.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved