- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- Cash Management

- Complete Bank Reconciliation Process

Complete Bank Reconciliation Process

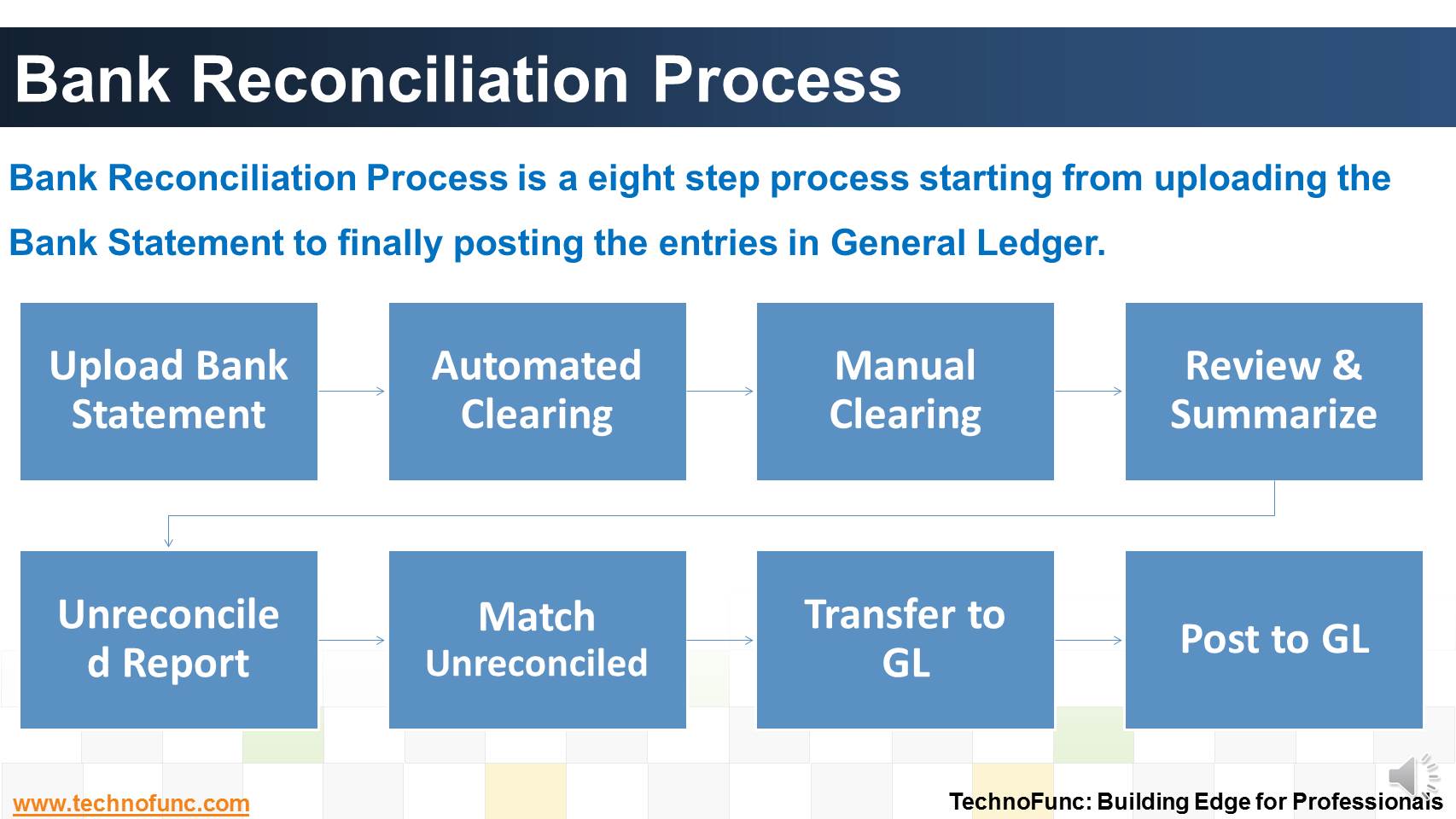

Bank Reconciliation Process is a eight step process starting from uploading the Bank Statement to finally posting the entries in General Ledger. Learn the Eight Steps in Detail!

Bank Reconciliation Process

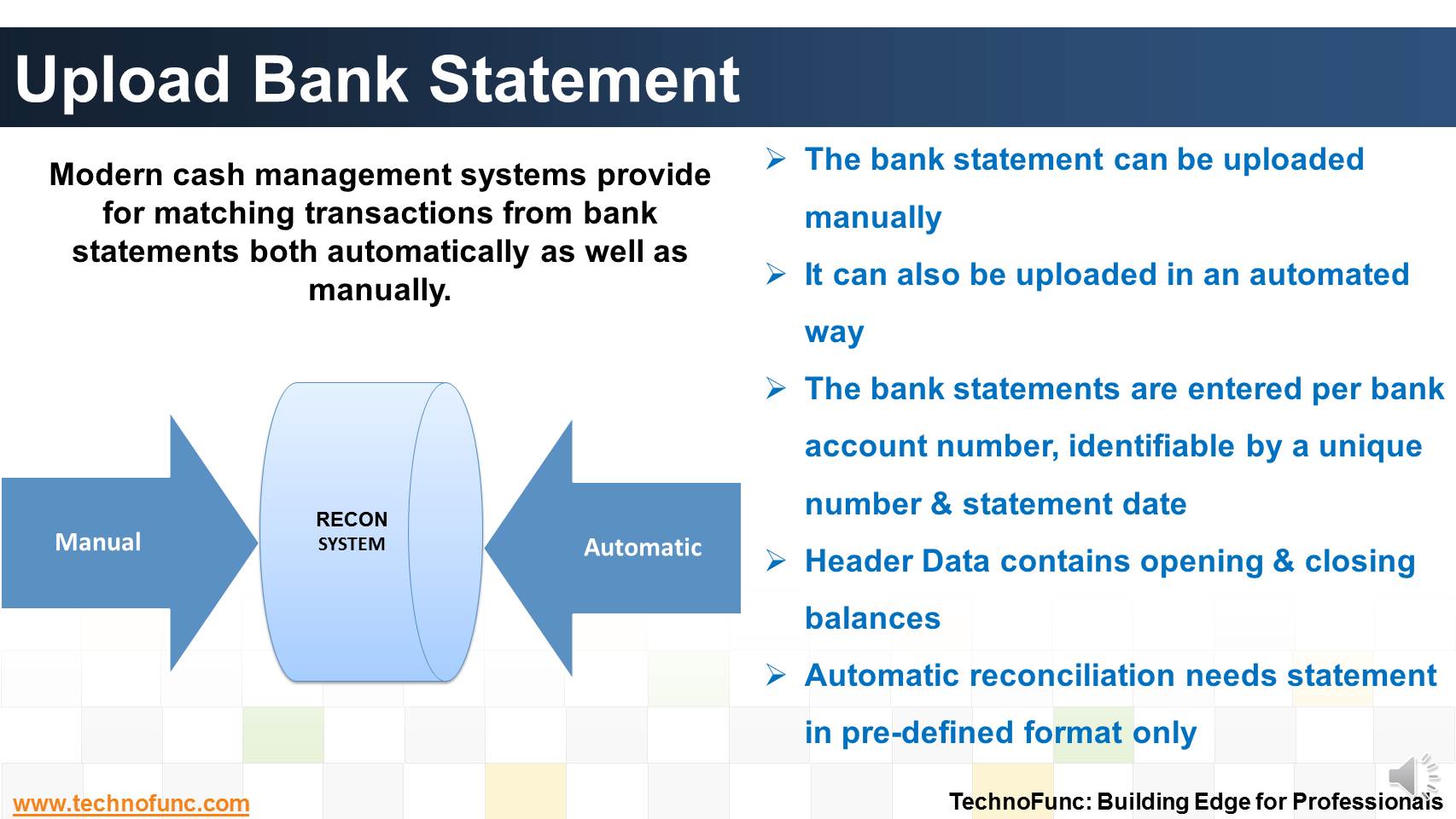

Step 1 is to Upload the Bank Statement

The bank statement can be either uploaded manually or in an automated way if available in the desired electronic formats. The bank statements entered are per bank account number and are identifiable by a unique number and statement date provided by the user.

In the header data, Bank statement opening balances and closing balances are provided before creating the bank statement that acts as a control check to ensure all transactions have been uploaded properly.

For the process of automatic bank reconciliation, generally the system requires electronic bank statement in a pre-defined format only.

Step 2 is to Reconcile with Bank Statement using Automated Clearing

Where Bank statement details are automatically matched and reconciled with system transactions.

This method is ideally suited for bank accounts that have a high volume of transactions.

Step 3 is the Manual Clearing

You use the manual reconciliation method to reconcile any bank statement details that could not be reconciled automatically.

Step 4 is to Review & Summarize

Once the reconciliation process, is complete a review of reconciliation results must be carried out. Generate various reports to support this process of review.

Step 5 is to generate Unreconciled Report

Generate a report with list of all un-reconciled entries, for further decision making and matching.

Step 6 is to Match Unreconciled Entries

Unmatched entries as reported by unreconciled report are to be investigated and matched manually. Open items in clearing account will be cleared to respective customer / vendor account after getting information from bank/ other sources.

The entries that still remain unmatched should to be manually transferred to "Unreconciled Account".

Step 7 is to Transfer to General Ledger

After the reconciliation process, the accounting entries generated will be passed to the general ledger. The receipt and payment entries will be transferred in to the actual Cash/Bank account in the General Ledger when posted.

Step 8 is to Post Entries in General Ledger

Once transferred to General Ledger, the next step is to makes the postings to the bank account, bank clearing account along with the payment clearing. The posting can be done for each journal or for the batch.

Related Links

You May Also Like

-

In automated clearing, Bank statement details are automatically matched and reconciled with system transactions. Learn how this process works and what are the perquisites to enable the same.

-

Cash Clearing – Accounting Entries

The Cash Clearing process enables you to track amounts that have actually cleared your bank. Learn the steps and accounting entries that gets generated during the cash clearing process.

-

Many different accounts are used in finance. Understand the representation and nature of clearing account in context of accounting, finance and ERP Systems.

-

Bank Reconciliation is a PROCESS to Validate the bank balance in the general ledger With Bank Statement. Learn the bank recon process.

-

The Cash Management component ensures that the enterprise has sufficient liquidity for payments that are due and to monitor payment flows. Learn how treasury plays an important role in cash management for the enterprise.

-

Treasury Management - Functions

Treasury management has become an specialized function. Treasury function helps in managing the Risk-return profile as well as the tax-efficiency of investment instruments. In larger firms, it may also include trading in bonds, currencies and financial derivatives. Learn about the various tasks, activities and imperatives, undertaken by treasuries in in today's context.

-

Although there is no straight forward answer to the question, how to best organize a treasury function, this article provides an generic view of the way large MNCs creates departments or sub-functions within the treasury function.

-

Effectively using cash management with trade finance products brings tangible benefits to both corporates and financial institutions.Learn the various benefits of cash management process.

-

Introduction to Cash Clearing Process

Unravel the mystery behind clearing accounts. Learn why clearing accounts are used in finance and accounting. Learn why so many clearing accounts are defined in ERPs and Automated Accounting Systems.

-

The objective of Financial risk management is to protect assets and cash flows from any risk. Treasury function works to accurately assess financial risks by identifying financial exposures including foreign exchange, interest rate, credit, commodity and other enterprise risks. Learn about the various risks that are managed by treasury.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved