- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- Cash Management

- Cash Management - Process

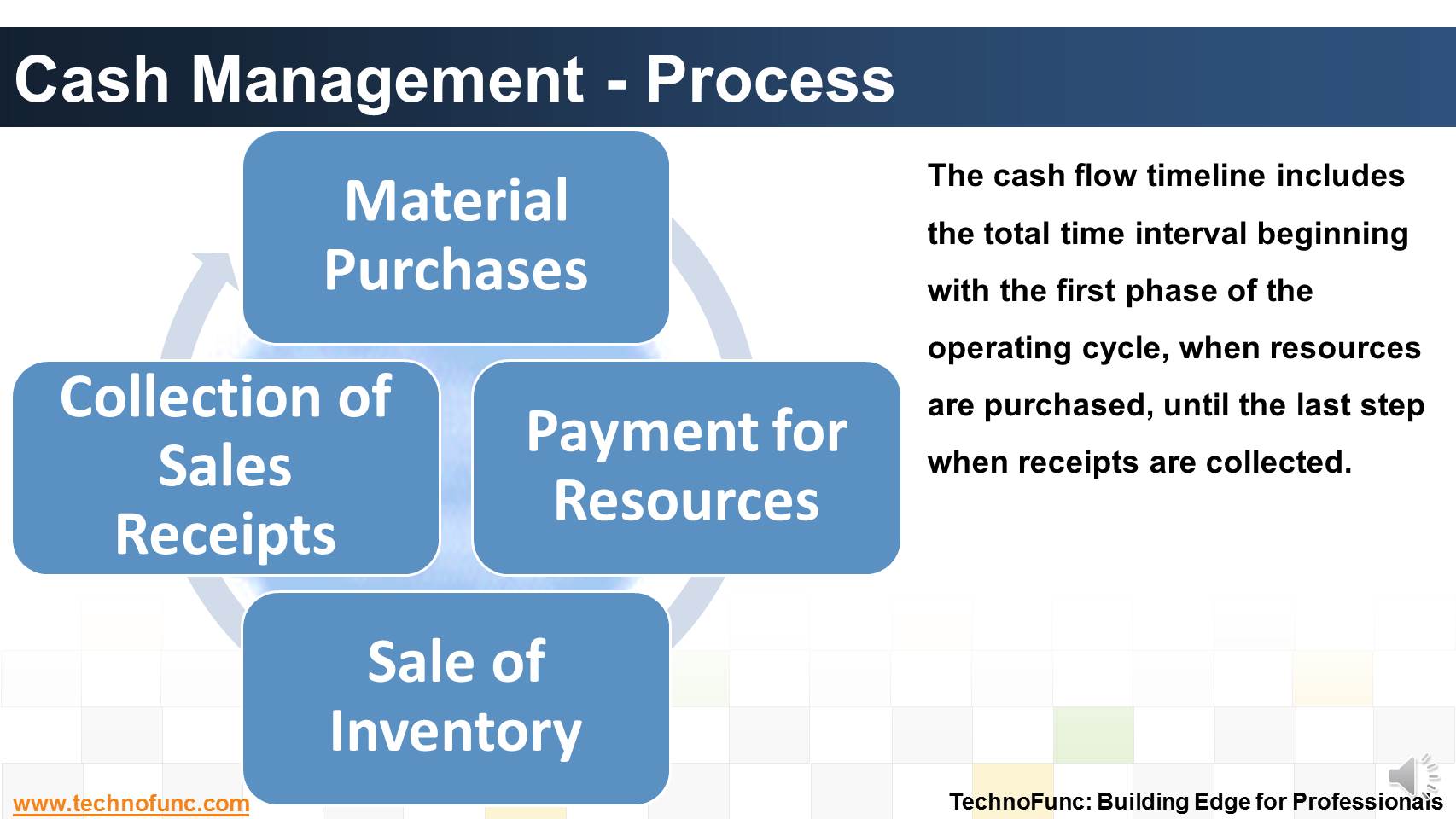

Cash Management - Process

How the inflow and outflow of cash is linked to the operating cycles of the business? Learn the cash management process in an enterprize and it's key components.

The cash flow timeline includes the total time interval beginning with the first phase of the operating cycle, when resources are purchased, until the last step when receipts are collected.

It consists of 4 basic steps.

1. Material purchases.

Acquisition of raw materials or merchandise for resale includes negotiation of the method of payment, credit terms and trade and payment discounts.

2. Payment for resources.

All resources required to support sales, including labor, marketing and overhead expenses, incur financing costs until cash is collected for sales made.

3. Sale of inventory or services.

Merchandise and other sales are most frequently accomplished by extending credit to customers. The timing of accounts receivable collection is a major focus in cash management.

4. Collection of receipts.

Only when the customer has provided good funds for the merchandise or service does the cash flow cycle conclude for that transaction.

Related Links

You May Also Like

-

Unravel the mystery behind clearing. Why we use clearing accounts. Find the relevance of word "Clearing" in business context.

-

In manual clearing, Bank statement details are to be matched manually considering certain rules. Learn the steps involved in manual clearing of bank transactions.

-

Technology has enabled the treasury function by providing various solutions to manage it's complicated tasks. This article explains various types of treasury management systems available in the market.

-

Have you ever wondered what is actually a Bank Statement and why it is needed. What is the information that is available in a bank statement?

-

Bank reconciliation process is targeted to validate the bank balance in the general ledger and explain the difference between the bank balance shown in an organization's bank statement. Learn the reasons for existence of differences between the two.

-

What is Invoice to Cash Process

In this article, we will explore the business process area known as; Invoice to Cash; Also known as I2C. Learning objectives for this lesson are: Meaning of Invoice to Cash Process; Sub Processes under Invoice to Cash; Process Flow for Invoice to Cash; Key Transactions Fields; Key Setups/Master Data Requirements.

-

How the inflow and outflow of cash is linked to the operating cycles of the business? Learn the cash management process in an enterprize and it's key components.

-

Cash Management - Integrations

Cash Management integrates cash transactions from various sources like Receivables, Payables, Treasury and creates reconciliation accounting entries after matching transactions with Bank Statements.

-

Before we dive into cash management, let us fist understand what we mean by cash and what constitutes cash in context of cash management process.

-

Complete Bank Reconciliation Process

Bank Reconciliation Process is a eight step process starting from uploading the Bank Statement to finally posting the entries in General Ledger. Learn the Eight Steps in Detail!

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved