- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- Treasury Management

- Bank Statement Lines

Bank Statement Lines

So many codes in the lines that are there in a Bank Statement. It contain lots and lots of meaningful information that can help automated many tasks. Explore more!

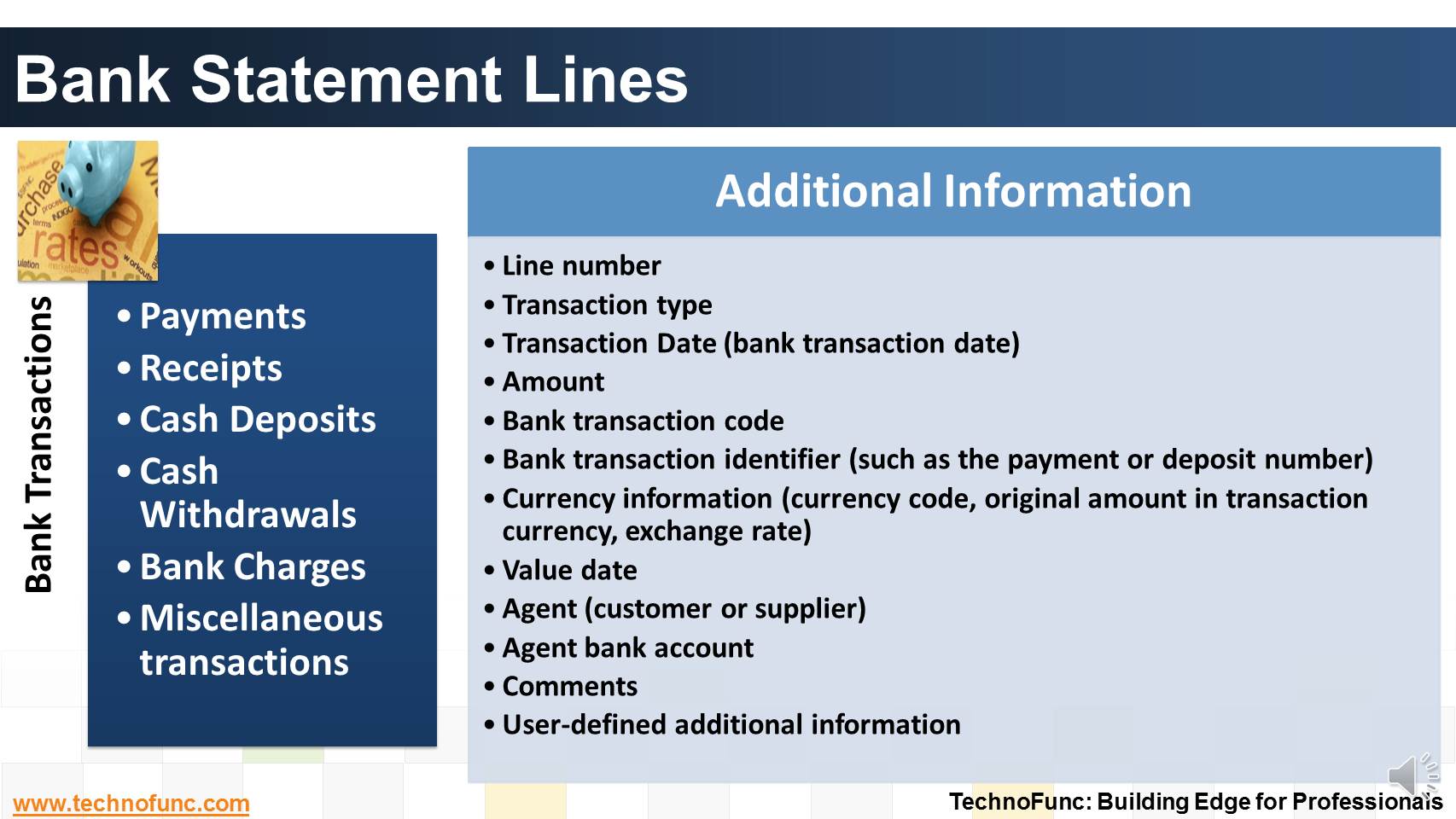

Bank Statement Lines

Given below are the types of transactions that generally constitute a bank statement-

- Payments

- Receipts

- Cashflows

- Miscellaneous transactions

- Each transaction is further supported with additional information.

The typically available information is could be of the nature shown here.

This additional information is very critical for automated reconciliations as you will notice in the upcoming articles.

Additional Information

- Line number

- Transaction type

- Transaction Date (bank transaction date)

- Amount

- Bank transaction code

- Bank transaction identifier (such as the payment or deposit number)

- Currency information (currency code, original amount in transaction currency, exchange rate)

- Value date

- Agent (customer or supplier)

- Agent bank account

- Comments

- User-defined additional information

Related Links

You May Also Like

-

How the inflow and outflow of cash is linked to the operating cycles of the business? Learn the cash management process in an enterprize and it's key components.

-

Cash Clearing – Accounting Entries

The Cash Clearing process enables you to track amounts that have actually cleared your bank. Learn the steps and accounting entries that gets generated during the cash clearing process.

-

Bank reconciliation process is targeted to validate the bank balance in the general ledger and explain the difference between the bank balance shown in an organization's bank statement. Learn the reasons for existence of differences between the two.

-

Treasury Management - Functions

Treasury management has become an specialized function. Treasury function helps in managing the Risk-return profile as well as the tax-efficiency of investment instruments. In larger firms, it may also include trading in bonds, currencies and financial derivatives. Learn about the various tasks, activities and imperatives, undertaken by treasuries in in today's context.

-

Effectively using cash management with trade finance products brings tangible benefits to both corporates and financial institutions.Learn the various benefits of cash management process.

-

Although there is no straight forward answer to the question, how to best organize a treasury function, this article provides an generic view of the way large MNCs creates departments or sub-functions within the treasury function.

-

Complete Bank Reconciliation Process

Bank Reconciliation Process is a eight step process starting from uploading the Bank Statement to finally posting the entries in General Ledger. Learn the Eight Steps in Detail!

-

Suspense and clearing accounts resemble each other in many respects but there exists important fundamental difference between the two. Read more to explore these differences.

-

In automated clearing, Bank statement details are automatically matched and reconciled with system transactions. Learn how this process works and what are the perquisites to enable the same.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved