- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- Order to Cash

- Bank Statement Lines

Bank Statement Lines

So many codes in the lines that are there in a Bank Statement. It contain lots and lots of meaningful information that can help automated many tasks. Explore more!

Bank Statement Lines

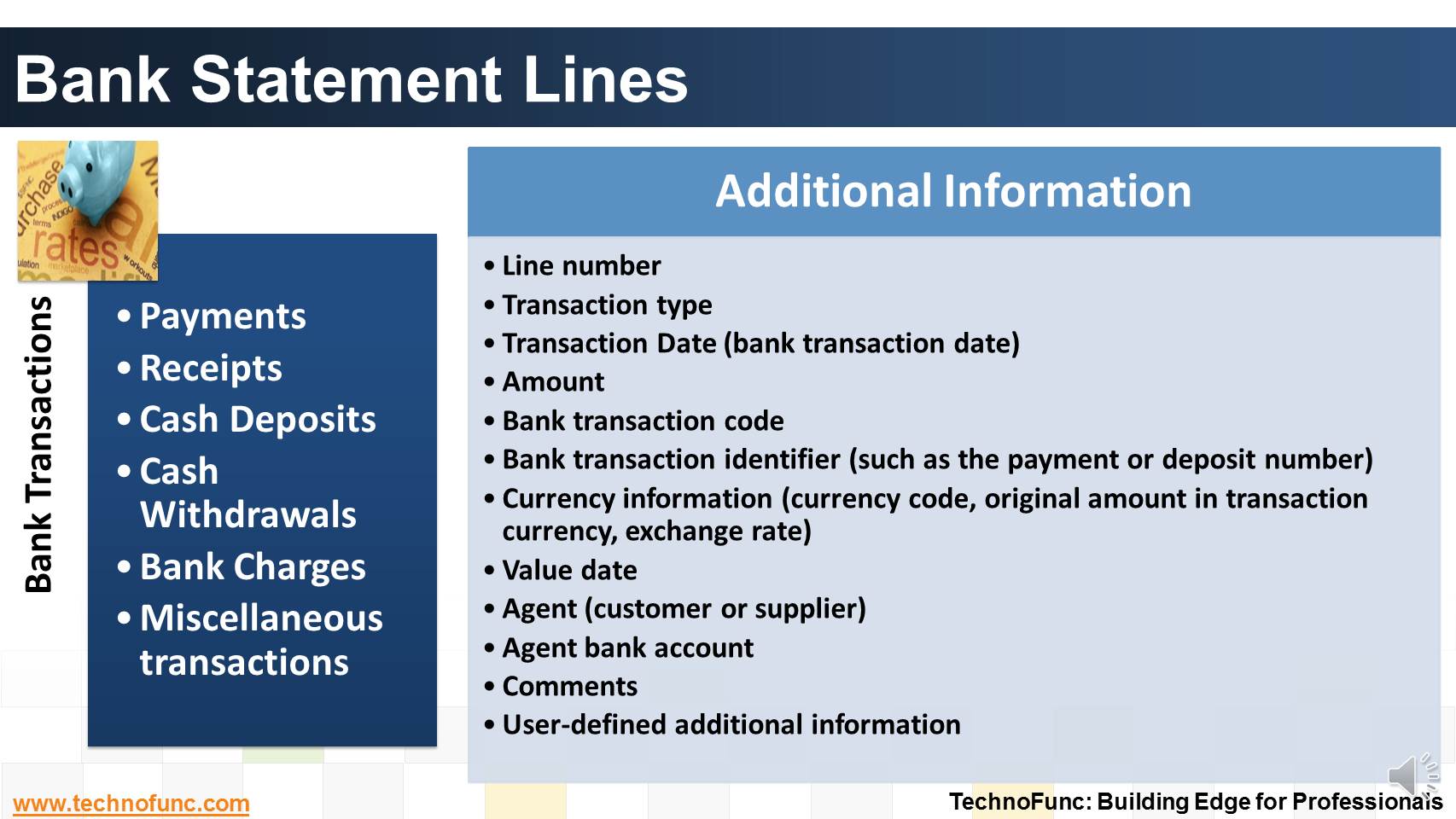

Given below are the types of transactions that generally constitute a bank statement-

- Payments

- Receipts

- Cashflows

- Miscellaneous transactions

- Each transaction is further supported with additional information.

The typically available information is could be of the nature shown here.

This additional information is very critical for automated reconciliations as you will notice in the upcoming articles.

Additional Information

- Line number

- Transaction type

- Transaction Date (bank transaction date)

- Amount

- Bank transaction code

- Bank transaction identifier (such as the payment or deposit number)

- Currency information (currency code, original amount in transaction currency, exchange rate)

- Value date

- Agent (customer or supplier)

- Agent bank account

- Comments

- User-defined additional information

Related Links

You May Also Like

-

The topic for this lesson is "Introduction to Cash Management Process". We start with the learning objectives for building requisite functional expertise in cash management process.

-

So many codes in the lines that are there in a Bank Statement. It contain lots and lots of meaningful information that can help automated many tasks. Explore more!

-

What is Invoice to Cash Process

In this article, we will explore the business process area known as; Invoice to Cash; Also known as I2C. Learning objectives for this lesson are: Meaning of Invoice to Cash Process; Sub Processes under Invoice to Cash; Process Flow for Invoice to Cash; Key Transactions Fields; Key Setups/Master Data Requirements.

-

The objective of Financial risk management is to protect assets and cash flows from any risk. Treasury function works to accurately assess financial risks by identifying financial exposures including foreign exchange, interest rate, credit, commodity and other enterprise risks. Learn about the various risks that are managed by treasury.

-

Have you ever wondered what is actually a Bank Statement and why it is needed. What is the information that is available in a bank statement?

-

In manual clearing, Bank statement details are to be matched manually considering certain rules. Learn the steps involved in manual clearing of bank transactions.

-

Introduction to Cash Clearing Process

Unravel the mystery behind clearing accounts. Learn why clearing accounts are used in finance and accounting. Learn why so many clearing accounts are defined in ERPs and Automated Accounting Systems.

-

In automated clearing, Bank statement details are automatically matched and reconciled with system transactions. Learn how this process works and what are the perquisites to enable the same.

-

Cash Management - Integrations

Cash Management integrates cash transactions from various sources like Receivables, Payables, Treasury and creates reconciliation accounting entries after matching transactions with Bank Statements.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved