- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- GL - Reversing Journal Entry

GL - Reversing Journal Entry

Reversing Journals are special journals that are automatically reversed after a specified date. A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries. See an example of reversing journal entry!

What is a Reversing Journal Entry?

A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries.

Reversing entry can be created in two ways. The first method is to use the same set of accounts with contra debits and credits, meaning that the accounts and amounts that were debited in the original entry will be credited with the same amount in the reversing journal “nullifying” the accounting impact. The second method is to create a journal with the same accounts but with negative amounts that will also nullify the accounting impact of the original transaction.

Automated Process Requirements:

- The accounts have been set up in the chart of accounts.

- The reversal criteria have been specified in the original adjustment or accrual journal, otherwise, the user generally needs to submit the journal manually for reversal.

- The date of the reversing journal has already been specified and the accounting period for that date is available for creating and posting transactions.

Process Flow Steps

- Enter a journal that reverses in the next month.

- Select the appropriate reversal option.

- At the beginning of the next period system creates a reversing entry dated the first day of the next accounting period.

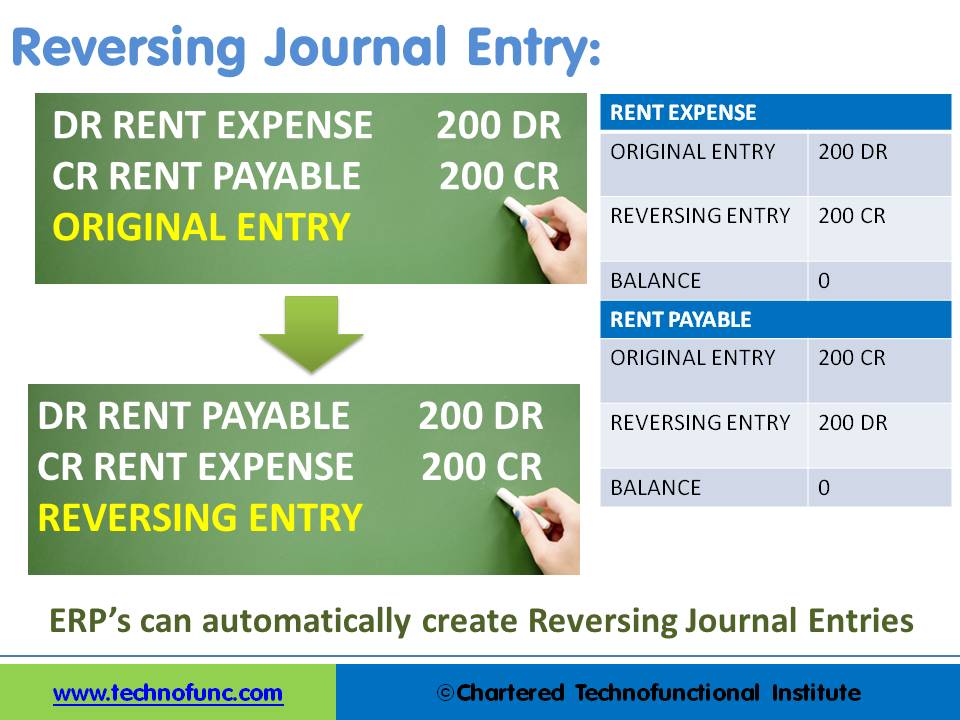

Example of a reversing entry:

The business has taken premises on rent. The rent payable for each month is $200 and the invoice is raised by the landlord on the 15th of the subsequent month. The accounting department takes 5 days to process the payment and deposit the amount in the Landlord’s account. December is the close of the accounting year and the invoice for rent for the month of December will be received by the company on the 15th of January and payment will be made by the 20th of January.

Closing Books: On the 31st of December, the accounting department passes the rent accrual accounting entry, debiting the “Rent Expense” and crediting the “Rent Payable Account”. This entry records the rent for the month of Dec and creates a liability for “Rent Payable” to the landlord next month. At the beginning of the next accounting year, on day one this entry is reversed by debiting the “Rent Payable” and crediting the “Rent Account”.

Making Payment: Once the payment for Rent is made on 20th January (Again by Debiting “Rent Expense” and Crediting “Bank Account”) this reversal will ensure that the rent for last year is not impacting the current year financials as the net impact on the “Rent Expense” account will be zero.

Related Links

You May Also Like

-

GL - Different Accounting Methods

The accounting method refers to the rules a company follows in reporting revenues and expenses. Understand the two common systems of bookkeeping, single, and double-entry accounting systems. Learners will also understand the two most common accounting methods; cash and accrual methods of accounting and the advantages and disadvantages of using them.

-

GL - Understanding Chart of Accounts

A chart of accounts (COA) is a list of the accounts used by a business entity to record and categorize financial transactions. COA has transitioned from the legacy accounts, capturing just the natural account, to modern-day multidimensional COA structures capturing all accounting dimensions pertaining to underlying data enabling a granular level of reporting. Learn more about the role of COA in modern accounting systems.

-

GL - Recurring Journal Entries

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Learn the various methods that can be used to generate recurring journals. See some examples and explore the generic process to create recurring journals in any automated system.

-

What Is a General Ledger? General Ledger (also known in accounting as the GL or the Nominal Ledger) is at the heart of any accounting system. A general ledger is the master set of accounts that summarize all transactions occurring within an entity. Ledger is the skillful grouping and presentation of the Journal entries. Learn the accounting fundamentals, general ledger process, and general ledger flow.

-

In this article, we will describe how to determine if an account needs adjustment entries due to the application of the matching concept. Learners will get a thorough understanding of the adjustment process and the nature of the adjustment entries. We will discuss the four types of adjustments resulting from unearned revenue, prepaid expenses, accrued expenses, and accrued revenue.

-

Period End Accruals, Receipt Accruals, Paid Time-Off Accruals, AP Accruals, Revenue Based Cost Accruals, Perpetual Accruals, Inventory Accruals, Accruals Write Off, PO Receipt Accrual, Cost Accrual, etc. are some of the most complex and generally misconstrued terms in the context of general ledger accounting. In this article, we will explore what is the concept of accrual and how it impacts general ledger accounting.

-

When the quantum of business is expected to be moderate and the entrepreneur desires that the risk involved in the operation be shared, he or she may prefer a partnership. A partnership comes into existence when two or more persons agree to share the profits of a business, which they run together.

-

Multitude of these legal and operational structures clubbed with accounting and reporting needs give rise to many reporting dimensions at which the organization may want to track or report its operational metrics and financial results. This is where business dimensions play a vital role.

-

For any company that has a large number of transactions, putting all the details in the general ledger is not feasible. Hence it needs to be supported by one or more subsidiary ledgers that provide details for accounts in the general ledger. Understand the concept of the subsidiary ledgers and control accounts.

-

Team-Based Organizational Structure

Team-based structure is a relatively new structure that opposes the traditional hierarchical structure and it slowly gaining acceptance in the corporate world. In such a structure, employees come together as team in order to fulfill their tasks that serve a common goal.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved