- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- Cash Management

- What is a Bank Statement?

What is a Bank Statement?

Have you ever wondered what is actually a Bank Statement and why it is needed. What is the information that is available in a bank statement?

Bank statement or account statement is a summary of financial transactions which have occurred over a given period on a bank account held by a person or business with a financial institution.

Bank statements have historically been and continue to be typically printed on one or several pieces of paper

They are either mailed directly to the account holder, or kept at the financial institution's local branch for pick-up.

In recent years there has been a shift towards paperless, electronic statements

Most financial institutions now offer direct download of bank statement into account holders accounting software.

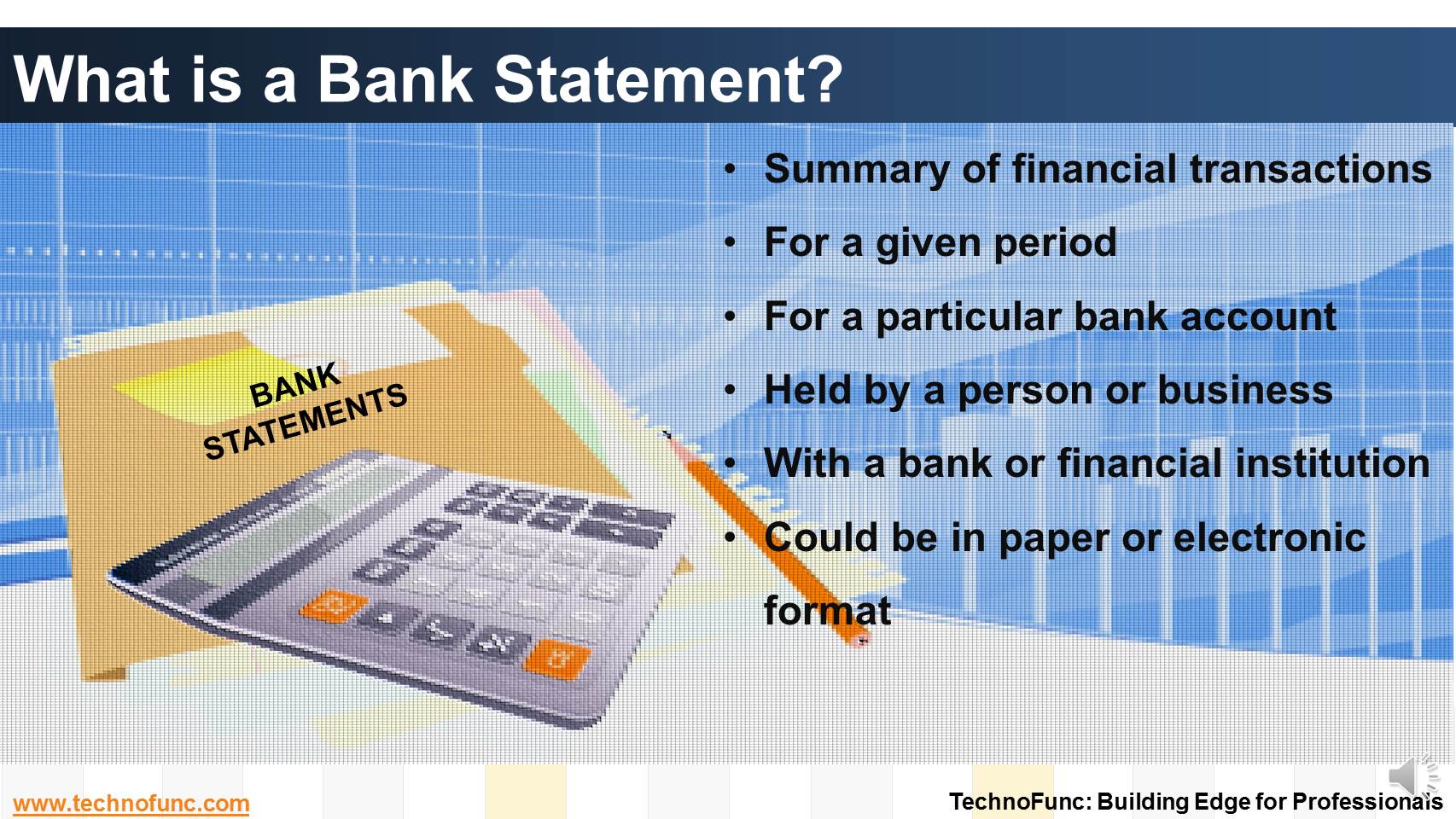

Key Attributes of Bank Statement:

- Summary of financial transactions

- For a given period

- For a particular bank account

- Held by a person or business

- With a bank or financial institution

- Could be in paper or electronic format

Related Links

You May Also Like

-

Cash Clearing – Accounting Entries

The Cash Clearing process enables you to track amounts that have actually cleared your bank. Learn the steps and accounting entries that gets generated during the cash clearing process.

-

Complete Bank Reconciliation Process

Bank Reconciliation Process is a eight step process starting from uploading the Bank Statement to finally posting the entries in General Ledger. Learn the Eight Steps in Detail!

-

Introduction to Cash Clearing Process

Unravel the mystery behind clearing accounts. Learn why clearing accounts are used in finance and accounting. Learn why so many clearing accounts are defined in ERPs and Automated Accounting Systems.

-

Although there is no straight forward answer to the question, how to best organize a treasury function, this article provides an generic view of the way large MNCs creates departments or sub-functions within the treasury function.

-

Before we dive into cash management, let us fist understand what we mean by cash and what constitutes cash in context of cash management process.

-

In manual clearing, Bank statement details are to be matched manually considering certain rules. Learn the steps involved in manual clearing of bank transactions.

-

Learning objectives for this lesson are: Meaning of Order to Cash Process; Sub Processes under Order to Cash; Process Flow for Order to Cash; Key Roles & Transactions; Key Setups/Master Data Requirements.

-

Treasury Management - Benefits

Effectively using treasury management with cash management and trade finance products brings tangible benefits to both corporates and financial institutions. Let us discuss some tangible benefits of treasury function.

-

Introduction to Bank Reconciliation Process

These set of articles provide a brief introduction to Bank Reconciliation Process. This topic not only discusses the meaning of bank reconciliation process but also discusses how this process in handled in new age ERPs and Automated Reconciliation Systems.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved