- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger

- GL - Reversing Journal Entry

GL - Reversing Journal Entry

Reversing Journals are special journals that are automatically reversed after a specified date. A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries. See an example of reversing journal entry!

What is a Reversing Journal Entry?

A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries.

Reversing entry can be created in two ways. The first method is to use the same set of accounts with contra debits and credits, meaning that the accounts and amounts that were debited in the original entry will be credited with the same amount in the reversing journal “nullifying” the accounting impact. The second method is to create a journal with the same accounts but with negative amounts that will also nullify the accounting impact of the original transaction.

Automated Process Requirements:

- The accounts have been set up in the chart of accounts.

- The reversal criteria have been specified in the original adjustment or accrual journal, otherwise, the user generally needs to submit the journal manually for reversal.

- The date of the reversing journal has already been specified and the accounting period for that date is available for creating and posting transactions.

Process Flow Steps

- Enter a journal that reverses in the next month.

- Select the appropriate reversal option.

- At the beginning of the next period system creates a reversing entry dated the first day of the next accounting period.

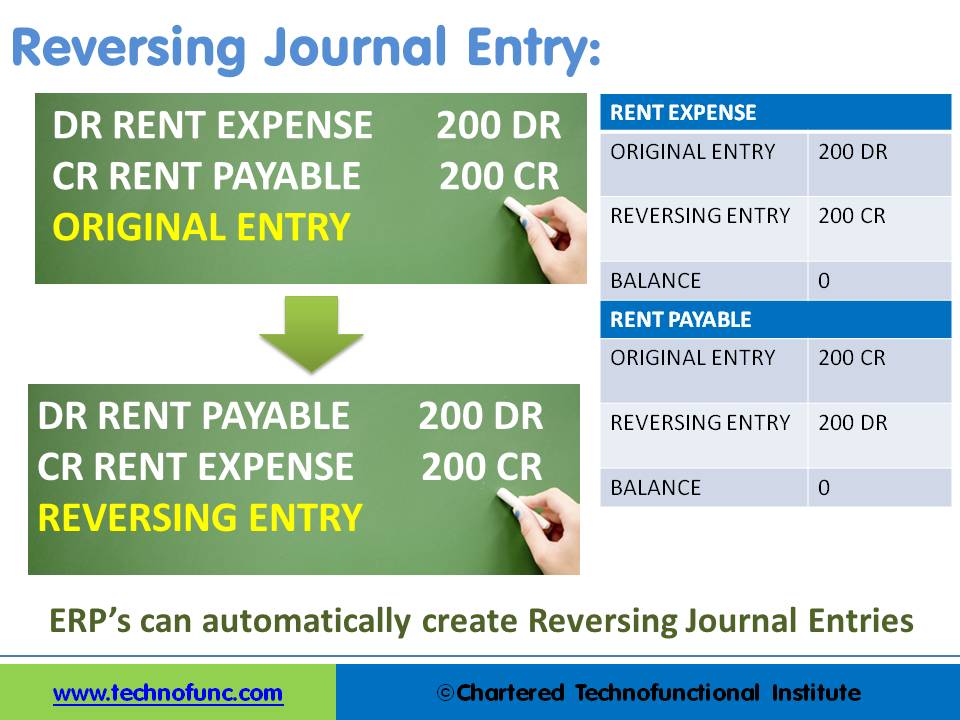

Example of a reversing entry:

The business has taken premises on rent. The rent payable for each month is $200 and the invoice is raised by the landlord on the 15th of the subsequent month. The accounting department takes 5 days to process the payment and deposit the amount in the Landlord’s account. December is the close of the accounting year and the invoice for rent for the month of December will be received by the company on the 15th of January and payment will be made by the 20th of January.

Closing Books: On the 31st of December, the accounting department passes the rent accrual accounting entry, debiting the “Rent Expense” and crediting the “Rent Payable Account”. This entry records the rent for the month of Dec and creates a liability for “Rent Payable” to the landlord next month. At the beginning of the next accounting year, on day one this entry is reversed by debiting the “Rent Payable” and crediting the “Rent Account”.

Making Payment: Once the payment for Rent is made on 20th January (Again by Debiting “Rent Expense” and Crediting “Bank Account”) this reversal will ensure that the rent for last year is not impacting the current year financials as the net impact on the “Rent Expense” account will be zero.

Related Links

You May Also Like

-

A subsidiary is a company that is completely or partly owned by another corporation that owns more than half of the subsidiary's stock, and which normally acts as a holding corporation which at least partly or wholly controls the activities and policies of the daughter corporation.

-

Divisional Organizational Structures

The divisional structure or product structure consists of self-contained divisions. A division is a collection of functions which produce a product. It also utilizes a plan to compete and operate as a separate business or profit center. Divisional structure is based on external or internal parameters like product /customer segment/ geographical location etc.

-

Period End Accruals, Receipt Accruals, Paid Time-Off Accruals, AP Accruals, Revenue Based Cost Accruals, Perpetual Accruals, Inventory Accruals, Accruals Write Off, PO Receipt Accrual, Cost Accrual, etc. are some of the most complex and generally misconstrued terms in the context of general ledger accounting. In this article, we will explore what is the concept of accrual and how it impacts general ledger accounting.

-

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

-

Five Core General Ledger Accounts

Typically, the accounts of the general ledger are sorted into five categories within a chart of accounts. Double-entry accounting uses five and only five account types to record all the transactions that can possibly be recorded in any accounting system. These five accounts are the basis for any accounting system, whether it is a manual or an automated accounting system. These five categories are assets, liabilities, owner's equity, revenue, and expenses.

-

Multitude of these legal and operational structures clubbed with accounting and reporting needs give rise to many reporting dimensions at which the organization may want to track or report its operational metrics and financial results. This is where business dimensions play a vital role.

-

In this article we will help you understand the double-entry accounting system and state the accounting equation and define each element of the equation. Then we will describe and illustrate how business transactions can be recorded in terms of the resulting change in the elements of the accounting equation.

-

In this article we will focus on and understand the accounting process which enables the accounting system to provide the necessary information to business stakeholders. We will deep dive into each of the steps of accounting and will understand how to identify accounting transactions and the process for recording accounting information and transactions.

-

Hierarchical Organization Structures

Hierarchical structure is typical for larger businesses and organizations. It relies on having different levels of authority with a chain of command connecting multiple management levels within the organization. The decision-making process is typically formal and flows from the top down.

-

A legal entity is an artificial person having separate legal standing in the eyes of law. A Legal entity represents a legal company for which you prepare fiscal or tax reports. A legal entity is any company or organization that has legal rights and responsibilities, including tax filings.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved