- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- Cash Management

- Sources of Cash

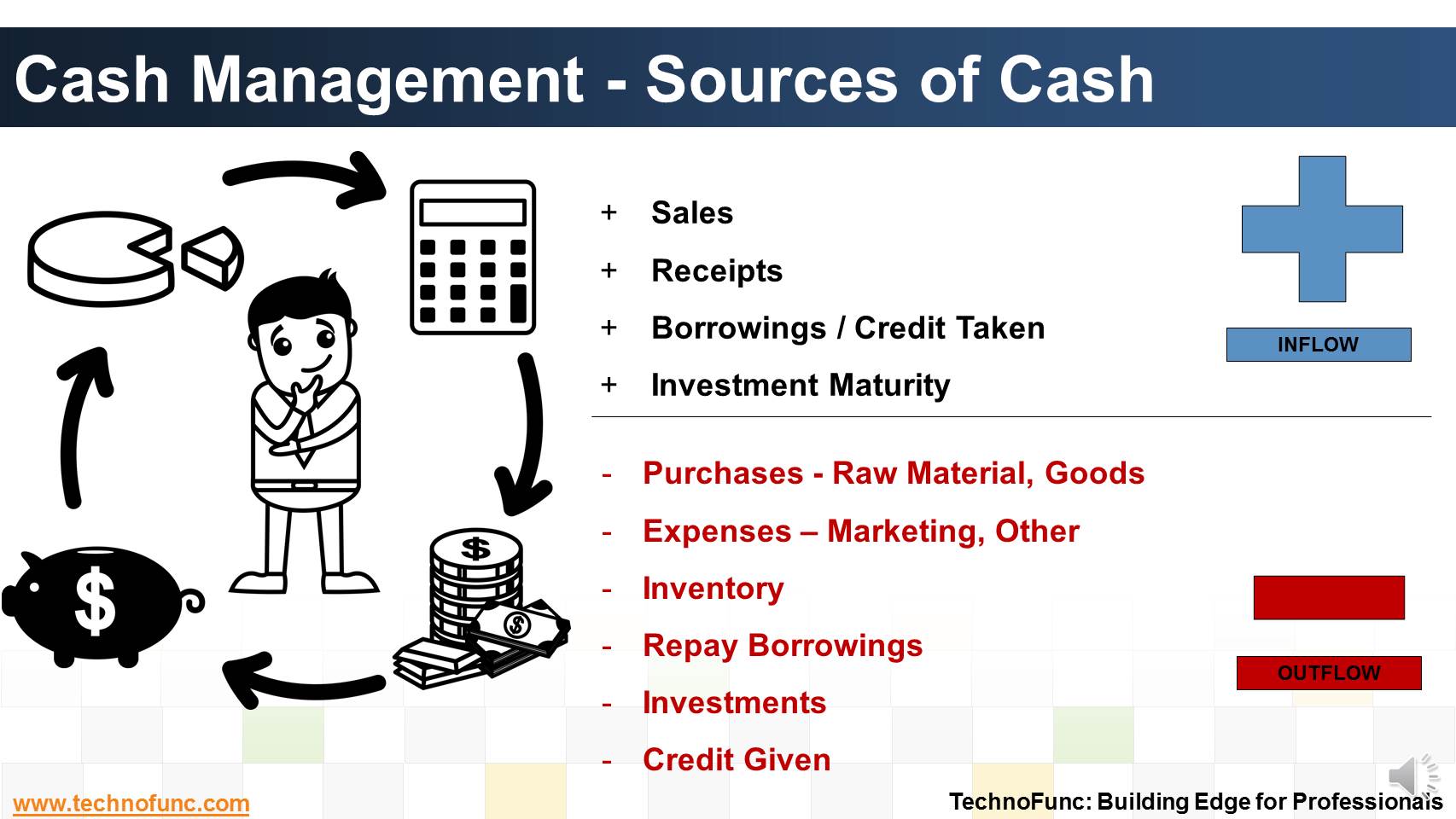

Sources of Cash

What are the various sources of cash in an organization. Which sources increase the cash available with the enterprise and which sources results in outflow of the cash? Let us explore!

Every successful company has a pool of cash that sustains the day-to-day activities of business.

It grows with receipts from sales and contributions and shrinks with expenditures for inventory, marketing, labor and other expenses.

The uncertainty of cash inflows and outflows creates the challenge of ensuring that sufficient funds are available at all times to support the operating cycle.

Borrowing becomes necessary when cash flow falls short of covering disbursements.

When incoming funds exceed the outflow, cash is used to repay borrowings or purchase short-term investments until the cash is needed to cover future expenses.

Financial officers need timely information to properly control and use their funds throughout the cash flow cycle.

The Basic Cash Management Process provides that timely information.

Related Links

You May Also Like

-

Complete Bank Reconciliation Process

Bank Reconciliation Process is a eight step process starting from uploading the Bank Statement to finally posting the entries in General Ledger. Learn the Eight Steps in Detail!

-

Introduction to Bank Reconciliation Process

These set of articles provide a brief introduction to Bank Reconciliation Process. This topic not only discusses the meaning of bank reconciliation process but also discusses how this process in handled in new age ERPs and Automated Reconciliation Systems.

-

The Cash Clearing process enables you to track amounts that have actually cleared your bank. Till reconciliation happens the amounts are parked in 'Cash Clearing Account'.

-

The terms Treasury Management and Cash Management are sometimes used interchangeably, while, in fact, the scope of treasury management is larger and includes funding and investment activities as well. Learn all about Treasury Management here!

-

What are the various sources of cash in an organization. Which sources increase the cash available with the enterprise and which sources results in outflow of the cash? Let us explore!

-

The Cash Management component ensures that the enterprise has sufficient liquidity for payments that are due and to monitor payment flows. Learn how treasury plays an important role in cash management for the enterprise.

-

The objective of funding Management is to implement strategies that lead to the best borrowing rates and lower investment costs. Learn how treasury aids in loans and investment management functions.

-

Disbursement Float is the time taken from payment creation to settlement. Collection float is the sum total of time taken by Payment Float; Mail Float; Processing Float and Availability Float. Learn more!

-

Bank Reconciliation is a PROCESS to Validate the bank balance in the general ledger With Bank Statement. Learn the bank recon process.

-

Cash Management - Integrations

Cash Management integrates cash transactions from various sources like Receivables, Payables, Treasury and creates reconciliation accounting entries after matching transactions with Bank Statements.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved