- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- Equity and Liability Accounts

Equity and Liability Accounts

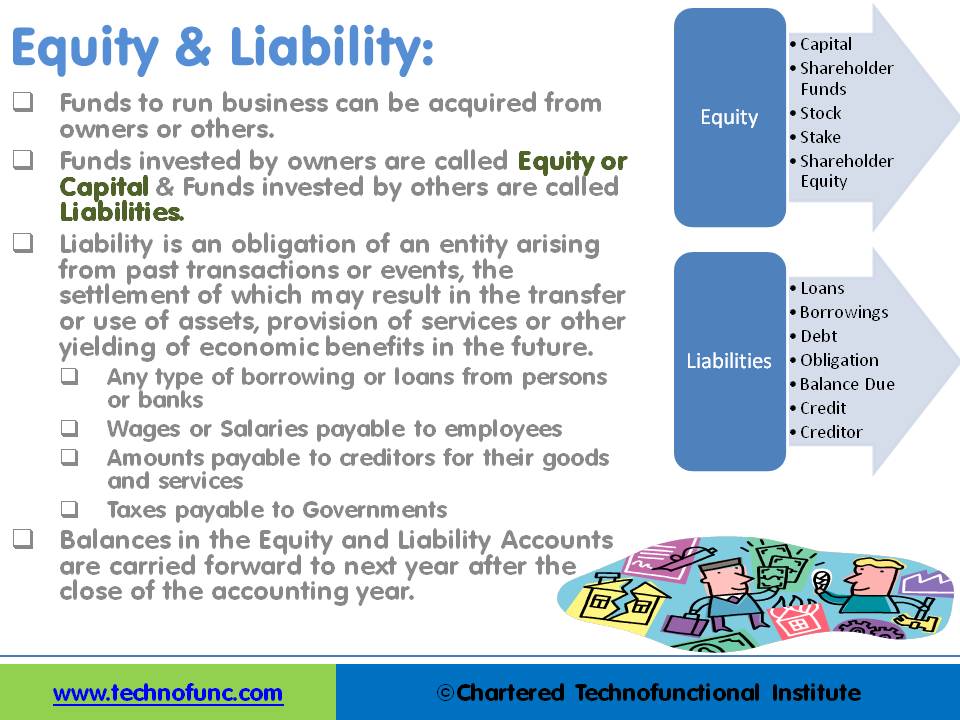

Funds contributed by owners in any business are different from all other types of funds. Equity is the residual value of the business enterprise that belongs to the owners or shareholders. The funds contributed by outsiders other than owners that are payable to them in the future. Liabilities are generally classified as Short Term (Current) and Long Term Liabilities. Current liabilities are debts payable within one year.

Equity Accounts:

The amount of the funds contributed by the owners (the stockholders) added or subtracted by accumulated gains and losses. Equity is the residual value of the business enterprise that belongs to the owners or shareholders.

Funds contributed by owners in any business are different from all other types of funds. Generally, they don’t have any cost of carrying for the business and in the event of winding up of the business, shareholders are entitled to the residual value of the business after discharging all other liabilities. They are expected to remain invested in the business for a long period of time and no immediate payback is anticipated in case of a going concern.

Equity accounts are also referred to as “Capital Account”, “Shareholder’s Funds” or “Accounts”, “Stock, Stake” and “Shareholder Equity”. Normally they have a credit balance and are reflected on the left side of the balance sheet. Profits and losses from each accounting year are added to Equity at the end of each year.

Balances in the Retained Earnings Account are transferred to “Equity” at the end of each accounting year. While running a revaluation of balances, equity is revalued using the historical rates in accordance with the accounting standards. Equity is a separate account type in ERP’s to segregate funds from owners and others.

Liability Accounts:

The number of funds contributed by outsiders other than owners that are payable to them in the future. Liability is an obligation of an entity arising from past transactions or events, the settlement of which may result in the transfer or use of assets, provision of services, or another yielding of economic benefits in the future.

Liabilities are generally classified as Short Term (Current) and Long Term Liabilities. Current liabilities are debts payable within one year, while long-term liabilities are debts payable over a longer period.

Liabilities can be from a lot of sources like Loans, External Borrowings, Debt – Secured and Unsecured, Obligation for services received Balance Due or Credit due to Creditors. Some generally known examples of liabilities are any type of borrowing or loans from persons or banks or wages or salaries paid to employees or amounts payable to creditors for their goods and services and taxes payable to Governments.

Balances in the Equity and Liability Accounts are carried forward to next year after the close of the accounting year. While running a revaluation of balances, liability is revalued using the period end rates in accordance with the accounting standards. Liability is a separate account type in ERP’s to segregate funds from owners and others.

Intercompany transactions also result in receivables and liabilities (payables) between different units of the same entity. Such transactions are settled in cash if they are in the normal course of business. At the time of the final consolidation of accounts, these intercompany liabilities and assets need to be eliminated from the books of the parent entity. We will discuss this concept in detail in the Intercompany chapter.

Related Links

You May Also Like

-

Introduction to Legal Entities Concept

Modern business organizations operate globally and leverage a large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders. Learn more about Legal Entities and their importance for businesses.

-

There are two commonly used methods of accounting - Cash Basis and the Accruals Basis. Understand the difference between accruals and reversals. Recap the earlier discussion we had on accruals and reversals and see the comparison between these two different but related accounting concepts. Understand how the action of accruing results in reversals subsequently in the accounting cycle.

-

In some of the ERP tools, there are more than 12 accounting periods in a financial year. This article discusses the concept of accounting calendar and accounting periods. Learn why different companies have different accounting periods. Understand some of the commonly used periods across different organizations and the definition & use of an adjustment period.

-

A legal entity is an artificial person having separate legal standing in the eyes of law. A Legal entity represents a legal company for which you prepare fiscal or tax reports. A legal entity is any company or organization that has legal rights and responsibilities, including tax filings.

-

In every journal entry that is recorded, the debits and credits must be equal to ensure that the accounting equation is matched. In this article, we will focus on how to analyze and recorded transactional accounting information by applying the rule of credit and debit. We will also focus on some efficient methods of recording and analyzing transactions.

-

Prepayments and Prepaid Expenses

Prepayments are the payment of a bill, operating expense, or non-operating expense that settle an account before it becomes due. Learn the concept of prepaid expenses. Understand the accounting treatment for prepaid expenses. Understand the concept by looking at some practical examples and finally learn the adjusting entry for these expenses.

-

Explore the concept of journal reversals and understand the business scenarios in which users may need to reverse the accounting entries that have been already entered into the system. Understand the common sources of errors resulting in the reversal of entries and learn how to correct them. Discuss the reversal of adjustment entries and the reversal functionalities in ERPs.

-

An account inquiry is a review of any type of financial account, whether it be a depository account or a credit account. In this tutorial, you learn what we mean by drill through functionality in the context of the general ledger system. We will explain the concept of drill-down and how it enables users to perform account and transaction inquiry at a granular level and the benefits of using this functionality.

-

For any company that has a large number of transactions, putting all the details in the general ledger is not feasible. Hence it needs to be supported by one or more subsidiary ledgers that provide details for accounts in the general ledger. Understand the concept of the subsidiary ledgers and control accounts.

-

A Company (also called corporation) may be understood as an association of persons in which money is contributed by them, to carry on some business or undertaking. Persons who contribute the money are called the shareholders or the members of the company. A corporation is an artificial being, invisible, intangible and existing only in contemplation of law. Being the mere creature of law, it possesses only those properties which the charter of its creation confers upon it.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved