- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- GL - Adjustment Entries

GL - Adjustment Entries

In this article, we will describe how to determine if an account needs adjustment entries due to the application of the matching concept. Learners will get a thorough understanding of the adjustment process and the nature of the adjustment entries. We will discuss the four types of adjustments resulting from unearned revenue, prepaid expenses, accrued expenses, and accrued revenue.

The Adjusting Process:

At the end of an accounting period, many of the balances of accounts in the ledger can be reported as they have been summarized in the general ledger system, without any changes, and financial statements can be generated for them. For example, the balances of the cash and land accounts are normally the amount reported on the balance sheet because we cash reflected in the balance sheet should be equal to the physical cash in hand, and the land is generally carried in the books at a historic cost.

Under the accrual basis, however, some accounts in the general ledger require updating (adjustment). For example, the balances listed for expenses that have been paid in advance like the advance rental for the lease period, are normally overstated because the use of these assets is not recorded on a day-to-day basis. The balance of the supplies accounts usually represents the cost of supplies at the beginning of the period plus the cost of supplies acquired during the period. To record the daily use of supplies would require many entries with small amounts. In addition, the total amount of supplies is small relative to other assets, and managers usually do not require day-to-day information about supplies.

This analysis and resulting updating of accounts at the end of the accounting period before the financial statements are prepared is called the adjusting process.

The Adjusting Entries:

The journal entries that bring the accounts up to date at the end of the accounting period are called adjusting entries. Adjusting entry is an accounting entry made at the end of the accounting period to allocate items between accounting periods. Generally adjusting entries are recorded at the end of the accounting period to adjust ledger accounts for any changes that relate to the current accounting period but have not yet been recorded.

Not all journal entries recorded at the end of a period are adjusting entries. The main purpose of adjusting entries is to match revenues and expenses to the current accounting period which is a requirement of the matching principle of accounting or to reconcile the different books of accounts like management books, consolidation books, and local statutory books by eliminating or adding entries requiring different treatment as per the different accounting standards or laws.

All adjusting entries generally affect at least one income statement account and one balance sheet account. Thus, an adjusting entry will always involve revenue or an expense account and an asset or a liability account.

Types of Adjusting Entries:

Most adjusting entries could be classified in the following four ways:

1. Prepayments/Deferral:

Cash has been paid or received before the actual consumption. These can be further classified as:

(A) Unearned Revenue: Revenues received in cash before they are earned

(B) Prepaid expenses: Expenses paid in cash before they are used

2. Accruals - Expenses / Revenues:

Actual consumption has happened and cash is yet to be received. These can be further classified as:

(A) Accrued Expenses: Expenses incurred not yet paid in cash

(B) Accrued Revenues: Revenues earned not yet received in cash

Similarly on the other hand an organization might have received services or products but has not paid them in cash or has provided services or products to its customers but not received the sales proceeds in cash. In both these cases, these accruals will result in adjusting entries. For example, there may be interest owed on debt or salaries owed but not yet paid to employees. Calculations must be done to determine those expense accruals—both an expense and a liability that is building over time. Revenue accruals are also possible. For example, interest may be accruing on an entity's investments and therefore an interest income accrual would need to be recognized that would have the effect of increasing assets (interest receivable) and increasing revenue (interest income). There are many types of accruals that may need to be recognized through a series of adjustments at the end of a period.

3. Prepayments or Deferrals:

Deferrals or prepayments are also a possible source of adjusting entries. There can be both deferred revenues and deferred expenses. Adjusting entries for prepayments are necessary to account for cash that has been received prior to the delivery of goods or completion of services. A company receiving the cash for benefits yet to be delivered will have to record the amount in an unearned revenue liability account. Then, an adjusting entry to recognize the revenue is used as necessary.

If cash or something of value has been received for future products or work to be performed, since the product hasn't been delivered or the service provided, the income must be deferred to a future date. Deferred income is recorded as an asset (most likely cash) and a liability (deferred revenue). Prepaid rent received by a landlord is an example of a deferral.

Similarly, Expenses can also be deferred. For example, if your company pays its insurance bill in advance for a period covering the next three years, only the amount attributed to this period’s insurance coverage would be an expense, while the remainder of the payment would be classified as a deferred expense. In this case, an asset called prepaid insurance would be established for the insurance paid representing future coverage.

In case of advance payments, when the cash is paid, it is first recorded in a prepaid expense asset account; the account is to be expensed either with the passage of time (e.g. rent, insurance) or through use and consumption (e.g. supplies).

Adjusted Trial Balance:

An Adjusted Trial Balance is a list of the balances of ledgers which is made after the adjusting entries are done. Adjusted trial balance contains balances of revenues and expenses along with those of assets, liabilities, and equities after the changes occur due to adjusting entries.

Adjusting Entries –Summary:

Based on the above discussion now let’s take a look at some accrual/deferral related concepts:

- Deferred income is recorded as an asset (most likely cash) and a liability (deferred revenue).

- In case of advance payments, when the cash is paid, it is first recorded in a prepaid expense asset account; the account is to be expensed either with the passage of time

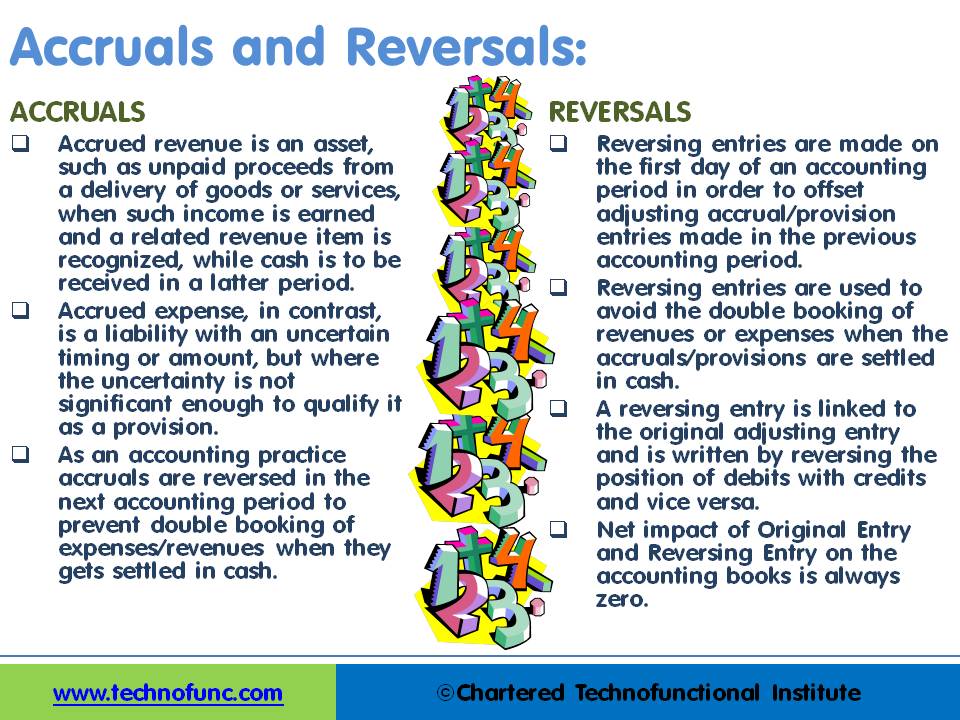

- Accrued revenue is an asset, such as unpaid proceeds from a delivery of goods or services, when such income is earned and a related revenue item is recognized, while cash is to be received in a later period.

- Accrued expense, in contrast, is a liability with an uncertain timing or amount, but where the uncertainty is not significant enough to qualify it as a provision.

- As an accounting practice expense and revenue accruals are reversed in the next accounting period to prevent double-booking of expenses/revenues when they get settled in cash.

Related Links

You May Also Like

-

Legal Structures in Businesses

Businesses not only vary in size and industry but also in their ownership. Most businesses evolve from being owned by just one person to a small group of people and eventually being managed by a large numbers of shareholders. Different ownership structures overlap with different legal forms that a business can take. A business’s legal and ownership structure determines many of its legal responsibilities.

-

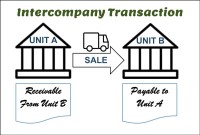

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

-

McKinsey 7S Framework is most often used as an organizational analysis tool to assess and monitor changes in the internal situation of an organization. The model is based on the theory that, for an organization to perform well, seven elements need to be aligned and mutually reinforcing.

-

In every journal entry that is recorded, the debits and credits must be equal to ensure that the accounting equation is matched. In this article, we will focus on how to analyze and recorded transactional accounting information by applying the rule of credit and debit. We will also focus on some efficient methods of recording and analyzing transactions.

-

Defining Organizational Hierarchies

A hierarchy is an ordered series of related objects. You can relate hierarchy with “pyramid” - where each step of the pyramid is subordinate to the one above it. One can use drill up or down to perform multi-dimensional analysis with a hierarchy. Multi-dimensional analysis uses dimension objects organized in a meaningful order and allows users to observe data from various viewpoints.

-

Horizontal or Flat Organizational Structures

Flat organizational structure is an organizational model with relatively few or no levels of middle management between the executives and the frontline employees. Its goal is to have as little hierarchy as possible between management and staff level employees. In a flat organizational structure, employees have increased involvement in the decision-making process.

-

Operational Structures in Business

Large organizations grow through subsidiaries, joint ventures, multiple divisions and departments along with mergers and acquisitions. Leaders of these organizations typically want to analyze the business based on operational structures such as industries, functions, consumers, or product lines.

-

A legal entity is an artificial person having separate legal standing in the eyes of law. A Legal entity represents a legal company for which you prepare fiscal or tax reports. A legal entity is any company or organization that has legal rights and responsibilities, including tax filings.

-

In this article, we explain some commonly used subsidiary ledgers like accounts receivable subsidiary ledger, accounts payable subsidiary ledger or creditors' subsidiary ledger, inventory subsidiary ledger, fixed assets subsidiary ledger, projects subsidiary ledger, work in progress subsidiary ledger, and cash receipts or payments subsidiary ledger.

-

Hierarchical Organization Structures

Hierarchical structure is typical for larger businesses and organizations. It relies on having different levels of authority with a chain of command connecting multiple management levels within the organization. The decision-making process is typically formal and flows from the top down.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved